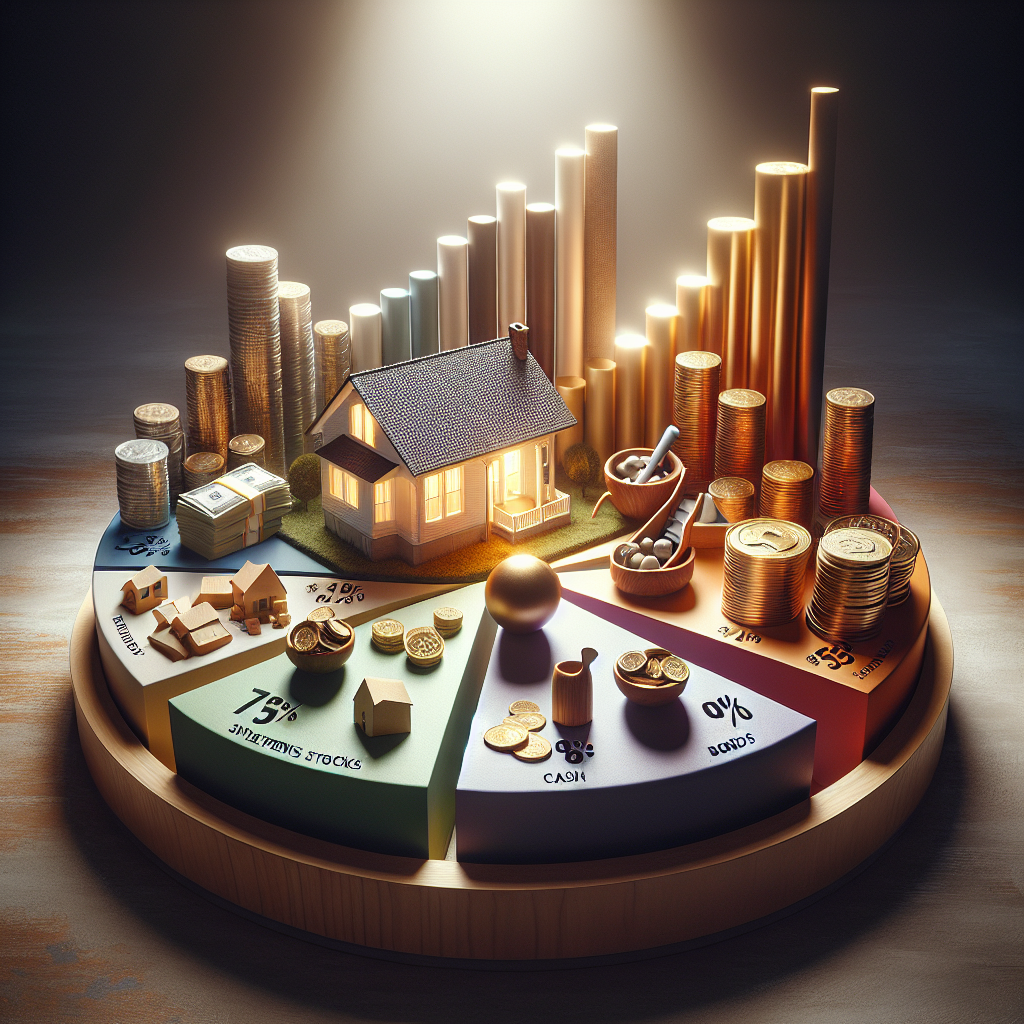

Analyzing recent shifts in SMSF investment patterns reveals ETFs surging to 57% adoption while property remains a cornerstone asset. Smart trustees are balancing strategic foundations with tactical flexibility, outperforming APRA funds by 1.2%. Size doesn’t limit diversification with today’s investment options. #SMSF asset allocation trends

SMSF Asset Allocation Trends: Is Your Retirement Strategy Still Working in 2023? Read More »