Are your LRBA interest rates draining your SMSF returns? With current rates between 7-8.14%, compared to 2.86% in 2022, your property investment could be costing thousands more yearly. Learn strategic approaches to maximize returns despite higher costs. #lrba interest rate

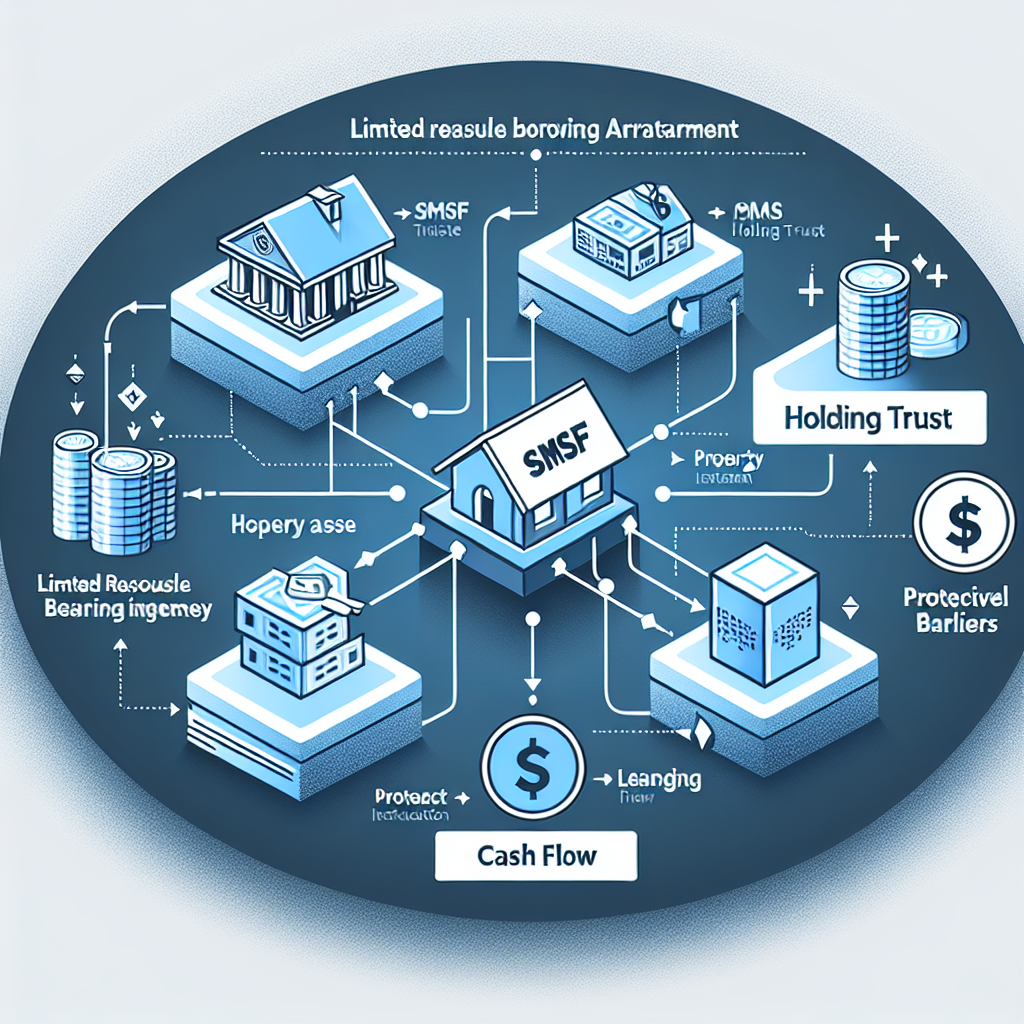

Looking to build retirement wealth through property? Our 10-step blueprint shows SMSF trustees how to leverage borrowing for property investments within regulatory guidelines. Learn the essentials of successful SMSF property investment strategy. #smsf borrowing for property

SMSF Borrowing for Property: The 10-Step Blueprint to Supercharge Your Retirement Wealth Read More »

SMSF Borrowing for Property: The 10-Step Blueprint to Supercharge Your Retirement Wealth

Looking to leverage your super fund for property investment? Granite SMSF loans offer no early repayment fees, exit fees, and a 100% offset account—making them ideal for maximizing your SMSF property portfolio’s potential with competitive rates and flexible terms. #granite smsf loans

Granite SMSF Loans: The Hidden Gem for Your Super Fund’s Property Investment Journey? Read More »

Granite SMSF Loans: The Hidden Gem for Your Super Fund’s Property Investment Journey?

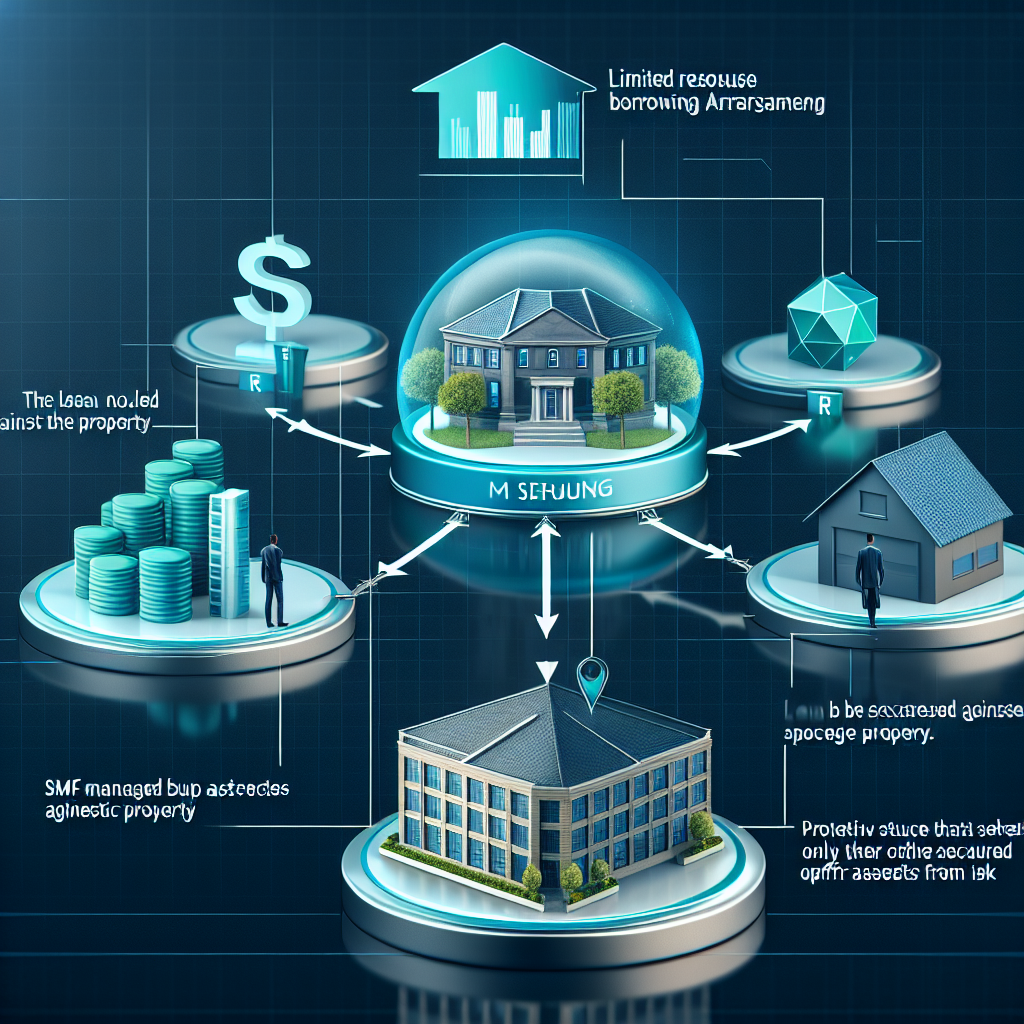

Navigating SMSF property investments? Discover exactly how much your self-managed super fund can borrow, the crucial LVR limits (typically 70-80%), and compliance requirements that protect your retirement savings. Strategic borrowing could be your path to property ownership. #how much can a smsf borrow to buy property

How Much Can a SMSF Borrow to Buy Property? The Secret Leverage Limit Every Trustee Needs to Know

Navigating the complex world of SMSF property investment? Our comprehensive guide reveals the top SMSF loan options for 2025, with competitive rates starting from 6.49% p.a. Don’t let your retirement fund miss these game-changing lending opportunities! #best smsf loans

Best SMSF Loans for 2025: Is Your Retirement Fund Missing These Game-Changing Lending Options?

Navigate the complex world of SMSF property investing with our comparison of top smsf home loan lenders. Find the perfect balance between competitive rates and exceptional service for your retirement portfolio. #smsf home loan lenders

SMSF Home Loan Lenders Showdown: Who Offers the Best Rates Without Sacrificing Service? Read More »

SMSF Home Loan Lenders Showdown: Who Offers the Best Rates Without Sacrificing Service?

Unlock your retirement potential through strategic property acquisition with SMSF investment loans. Learn how these specialized borrowing arrangements can expand your portfolio, enhance diversification, and accelerate wealth creation while navigating regulatory requirements. #smsf investment loans

SMSF Investment Loans: The Secret Weapon for Supercharging Your Retirement Portfolio? Read More »

SMSF Investment Loans: The Secret Weapon for Supercharging Your Retirement Portfolio?

Navigating SMSF property investment? Before choosing an SMSF loan broker, ask these 5 essential questions to protect your retirement future. Don’t risk your financial security with the wrong advisor. Expert guidance makes all the difference. #smsf loan broker

SMSF Loan Broker: Your Financial Future Depends on Asking These 5 Critical Questions First

Unlock your SMSF’s full potential with expert guidance from specialized SMSF home loan brokers. Navigate complex regulations, access exclusive deals, and maximize your retirement portfolio through strategic property investments—all while maintaining strict compliance. #smsf home loan broker

SMSF Home Loan Broker: The Secret Weapon Your Retirement Fund Has Been Missing Read More »