For SMSF trustees, navigating the complex landscape of borrowing rules can feel like walking through a financial minefield. The ability to borrow within your self-managed super fund opens up significant investment opportunities, particularly in property, but comes with a strict regulatory framework that demands careful attention. Understanding these rules isn’t just about compliance—it’s about protecting your retirement savings and maximizing your fund’s growth potential.

The Australian Taxation Office (ATO) maintains vigilant oversight of SMSF borrowing rules, with severe penalties for non-compliance that can impact both your fund and your personal finances. Recent statistics show that borrowing-related breaches are among the most common compliance issues flagged during SMSF audits, highlighting just how challenging this area can be for trustees.

“Many trustees underestimate the complexity of SMSF borrowing rules until they’re faced with potential breaches,” notes a senior financial advisor specializing in superannuation. “By then, it’s often too late to avoid penalties.“

Understanding Limited Recourse Borrowing Arrangements (LRBAs)

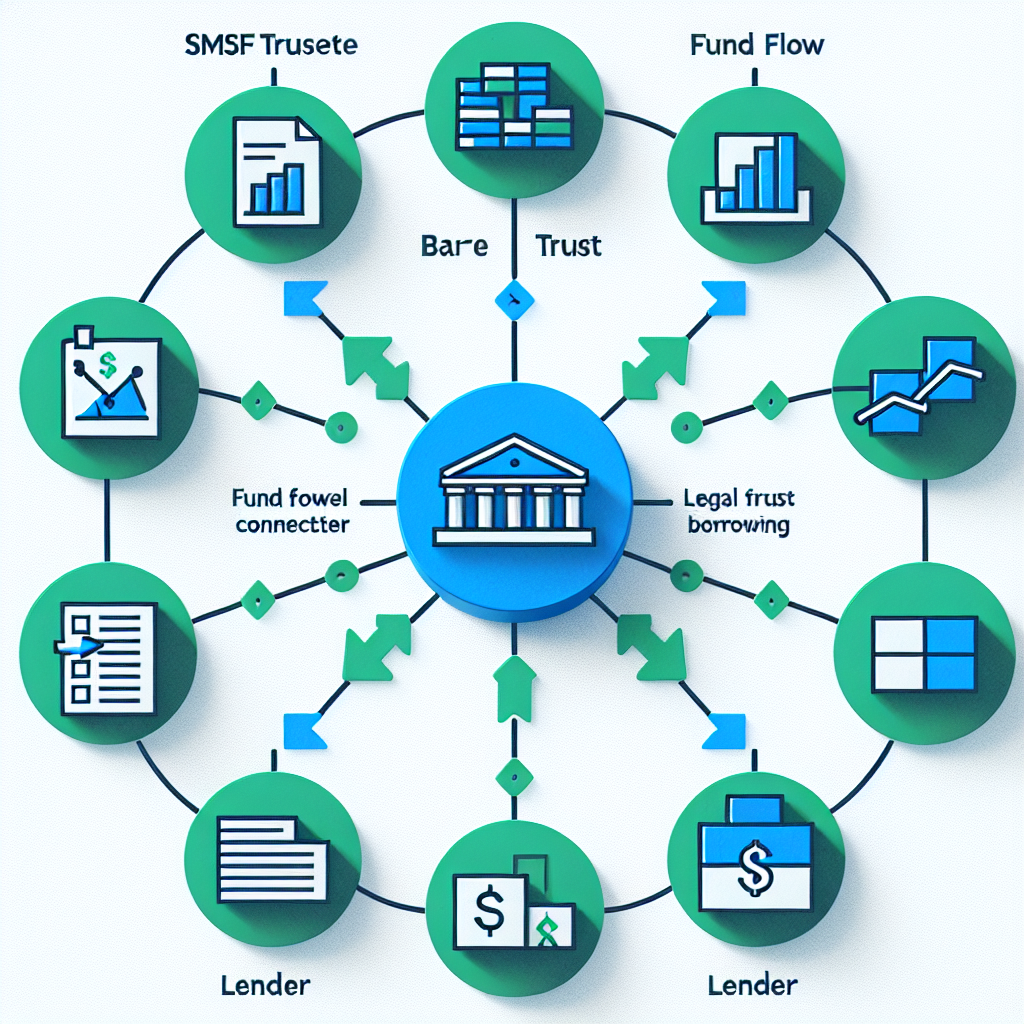

At the heart of SMSF borrowing rules lies the Limited Recourse Borrowing Arrangement (LRBA). This specialized structure allows your fund to borrow money specifically to purchase a single acquirable asset (or collection of identical assets with the same market value), such as property or shares.

The “limited recourse” element is crucial—it means that if your SMSF defaults on the loan, the lender’s rights are restricted to the specific asset purchased with the borrowed funds. This critical protection prevents other assets in your SMSF from being seized, safeguarding the broader retirement savings of all members.

The structure of an LRBA typically involves:

- Your SMSF trustee taking out a loan

- Using the borrowed funds to purchase a single asset

- Holding that asset in a separate holding trust

- The SMSF having the beneficial right to acquire legal ownership once the loan is repaid

According to ATO guidelines, your SMSF can borrow for a maximum of 90 days to meet benefit payments due to members, with the borrowed amount not exceeding 10% of the fund’s total assets. For longer-term borrowing through an LRBA, different restrictions apply.

Interest rates for LRBA loans typically sit 2-3% higher than standard loans due to their limited recourse nature, making careful financial planning essential before committing to this strategy.

Borrowing Limits and Restrictions

Important: SMSF borrowing limits are designed to protect your retirement funds while allowing strategic investment growth. Understanding these restrictions is critical for successful fund management.

The SMSF borrowing rules impose several important limitations that trustees must understand:

Single Acquirable Asset Rule: Perhaps the most fundamental restriction is that borrowed funds must be used to purchase a single acquirable asset or a collection of identical assets with the same market value. This prevents trustees from using borrowed money for diversified investment portfolios or multiple property purchases under a single loan.

No Improvement Restrictions: While maintenance and repairs are permitted, borrowed funds cannot be used to “improve” an asset in a way that fundamentally changes its character. For example, you can renovate a kitchen in an investment property, but you cannot use borrowed funds to demolish a house and build apartments.

In-house Asset Restrictions: Your SMSF is restricted from having in-house assets (such as investments in a related party’s business) comprising more than 5% of the market value of the fund’s total assets.

Short-term Borrowing Caps: For temporary borrowing needs, your SMSF can borrow money for a maximum of 90 days to meet benefit payments, with the borrowed amount capped at 10% of the fund’s total assets.

These limitations are designed to mitigate risk and ensure that SMSF borrowing aligns with the primary purpose of superannuation—providing retirement benefits to members.

Compliance Guidelines for SMSF Trustees

Compliance Alert: The ATO has increased scrutiny of SMSF borrowing arrangements in recent years. Ensuring your documentation and processes are correct from the outset can save significant headaches later.

Strict adherence to compliance requirements is non-negotiable when implementing SMSF borrowing rules. Here are the key compliance elements trustees must address:

Documentation Requirements

Proper documentation forms the foundation of LRBA compliance. At minimum, you’ll need:

- A formal loan agreement with commercial terms

- A bare trust deed establishing the holding trust

- Evidence that the asset is held by the holding trustee

- Records showing the SMSF’s beneficial ownership

- Proof that loan repayments come from the SMSF

These documents must be properly executed and maintained throughout the life of the arrangement. Any amendments or variations must be documented with the same level of formality. The ATO provides detailed guidance on documentation requirements for LRBAs.

Trustee Duties

As an SMSF trustee engaging in borrowing, your responsibilities include:

- Acting in the best interest of all members

- Ensuring the borrowing arrangement complies with relevant legislation

- Maintaining arm’s length transactions (especially important if dealing with related parties)

- Regularly reviewing the arrangement as part of your investment strategy

The ATO can disqualify trustees who fail to meet their obligations, and this disqualification is permanent—not just specific to the SMSF they were trustee of at the time of the breach.

Regulatory Oversight

The ATO actively monitors SMSF borrowing arrangements, focusing on:

- Whether the arrangement is genuinely limited recourse

- If loan terms reflect commercial rates and conditions

- Compliance with the sole purpose test

- Whether related-party transactions occur at arm’s length

Trustees should prepare for potential ATO scrutiny by maintaining comprehensive records and ensuring all aspects of the arrangement align with current regulations.

Investment Strategy Alignment

Your fund’s investment strategy must specifically address how the borrowing arrangement:

- Fits with the fund’s overall investment approach

- Manages risk, including loan repayment capabilities

- Provides for liquidity needs

- Considers diversification requirements

- Addresses the insurance needs of members

“An SMSF investment strategy isn’t a ‘set and forget’ document,” explains an SMSF specialist. “It needs to evolve as your borrowing arrangements and fund circumstances change.“

Ongoing Responsibilities After Loan Acquisition

Pro Tip: Establish a calendar reminder system for all ongoing LRBA obligations to ensure you never miss critical compliance deadlines.

Acquiring an asset through an LRBA is just the beginning. SMSF trustees face continuing obligations throughout the life of the loan:

Monitoring Fund Performance

Regular assessment of your fund’s performance becomes even more critical when borrowing is involved. This includes:

- Tracking the performance of the acquired asset against projections

- Ensuring loan repayments remain sustainable

- Adjusting strategies if fund cash flow is compromised

A recent analysis of SMSF performance data revealed that funds with well-managed LRBAs showed average annual returns 1.2% higher than comparable funds without borrowing arrangements—demonstrating that proper management can enhance outcomes.

Maintaining Compliance

Ongoing compliance responsibilities include:

- Ensuring all loan repayments are made directly from the SMSF

- Keeping the holding trust arrangement intact until the loan is fully repaid

- Properly accounting for income and expenses related to the asset

- Managing any repairs or maintenance without crossing into “improvement” territory

- Conducting annual audits with particular attention to borrowing compliance

The compliance landscape isn’t static either—trustees must stay informed about regulatory changes that might affect their borrowing arrangements.

Strategic Investment Principles

Effective SMSF borrowing should align with sound investment principles:

- Maintain sufficient liquidity to meet loan obligations even during market downturns

- Consider diversification beyond the leveraged asset

- Implement risk management strategies, including appropriate insurance

- Regularly review the investment’s performance against your retirement goals

- Plan for eventual loan repayment and transfer of legal ownership to the SMSF

“Strategic SMSF borrowing isn’t about maximizing leverage—it’s about judicious use of debt to enhance long-term retirement outcomes,” notes a financial strategist specializing in SMSF lending.

Making Informed Decisions About SMSF Borrowing

When considering SMSF borrowing, trustees should approach the decision with both caution and strategic insight. Here are key considerations:

Due Diligence is Essential

Before establishing an LRBA, conduct thorough due diligence:

- Obtain independent valuations of potential investments

- Calculate all costs, including loan establishment fees, legal expenses, and ongoing management

- Model different economic scenarios to test the resilience of your repayment strategy

- Consider the impact on member benefits, especially for funds with members approaching retirement

Seek Specialized Advice

The complexity of SMSF borrowing rules demands specialized knowledge. Work with SMSF loan brokers who have specific expertise in:

- SMSF compliance requirements

- Property investment (if purchasing real estate)

- Financial modeling for leveraged investments

- Tax implications of different borrowing structures

Balance Risk and Opportunity

While borrowing can amplify returns, it also increases risk. Successful SMSF trustees find the right balance by:

- Starting with conservative loan-to-value ratios

- Ensuring sufficient insurance coverage

- Maintaining cash reserves for unexpected expenses

- Regularly stress-testing their borrowing strategy against potential market downturns

Conclusion: Diligence and Understanding are Key

Remember: While SMSF borrowing offers significant opportunities, success depends on your commitment to understanding and following the rules. When in doubt, seek professional advice before proceeding.

SMSF borrowing rules create valuable opportunities for trustees to build wealth through strategic leverage, but they come with significant responsibilities. The complex regulatory framework demands thorough understanding, careful planning, and ongoing diligence.

As with all aspects of SMSF management, the key to success lies in education, preparation, and appropriate professional support. By fully understanding your compliance obligations and approaching borrowing as part of a coherent investment strategy, you can effectively navigate the rules while minimizing risk.

At Aries Financial, we believe that informed trustees make better decisions. Our approach to SMSF lending emphasizes integrity, expertise, and empowerment—providing you with both the financial solutions and the knowledge you need to leverage borrowing opportunities within your fund.

Whether you’re considering your first LRBA or reviewing existing arrangements, remember that compliance and strategy go hand-in-hand. The most successful SMSF borrowing strategies are those that not only satisfy regulatory requirements but also align perfectly with your fund’s long-term investment goals and the retirement objectives of all members.

By approaching SMSF borrowing rules with the respect they deserve and seeking appropriate guidance when needed, you can confidently take the plunge into leveraged investment while protecting what matters most—the financial future of your fund’s members.