In today’s dynamic investment landscape, Self-Managed Super Fund (SMSF) trustees are increasingly looking beyond traditional investment vehicles to maximize their retirement savings. Property investment through an SMSF has emerged as a powerful strategy, but many trustees remain unaware of their fund’s true borrowing potential. This is where understanding your SMSF borrowing power becomes not just beneficial, but essential.

Your super fund might be hiding untapped property investment potential that could significantly enhance your retirement portfolio. Whether you’re an experienced SMSF trustee or just beginning your journey into self-managed superannuation, knowing exactly what your fund can borrow is the crucial first step toward making strategic property investment decisions.

Understanding SMSF Borrowing Power: The Foundation of Strategic Property Investment

The primary elements that influence your SMSF borrowing power include:

Fund Balance: The total assets currently held within your SMSF form the foundation of your borrowing capacity. Generally, a higher fund balance translates to greater borrowing potential.

Income Generation: The ongoing income your fund receives, including member contributions, rental income from existing properties, and returns from other investments, plays a crucial role in determining serviceability.

Current Liabilities: Any existing loans or financial obligations of the fund will reduce its capacity to take on additional debt.

Target Property Value: The specific property you’re aiming to purchase will impact borrowing calculations, with factors such as potential rental yield being particularly important.

Member Contributions: Regular and consistent contributions from members strengthen the fund’s financial position and can enhance borrowing capacity.

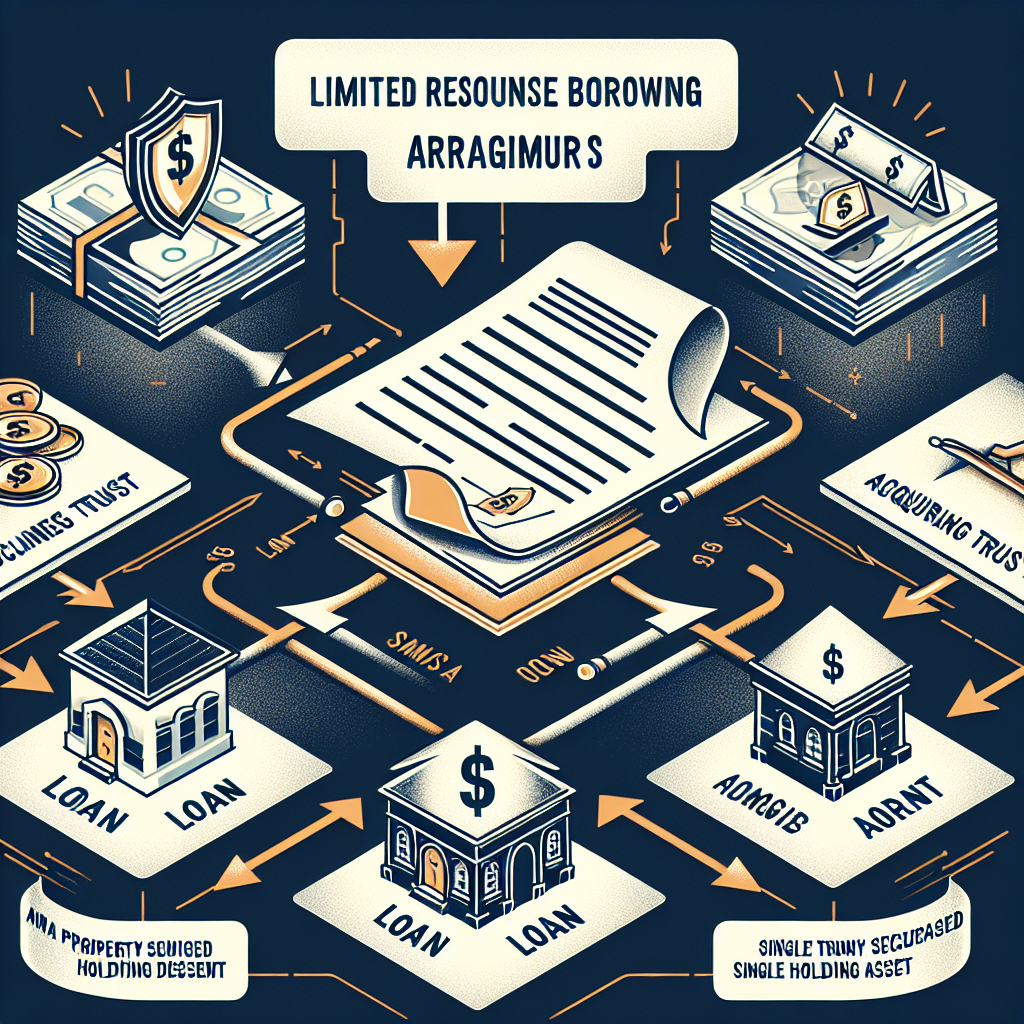

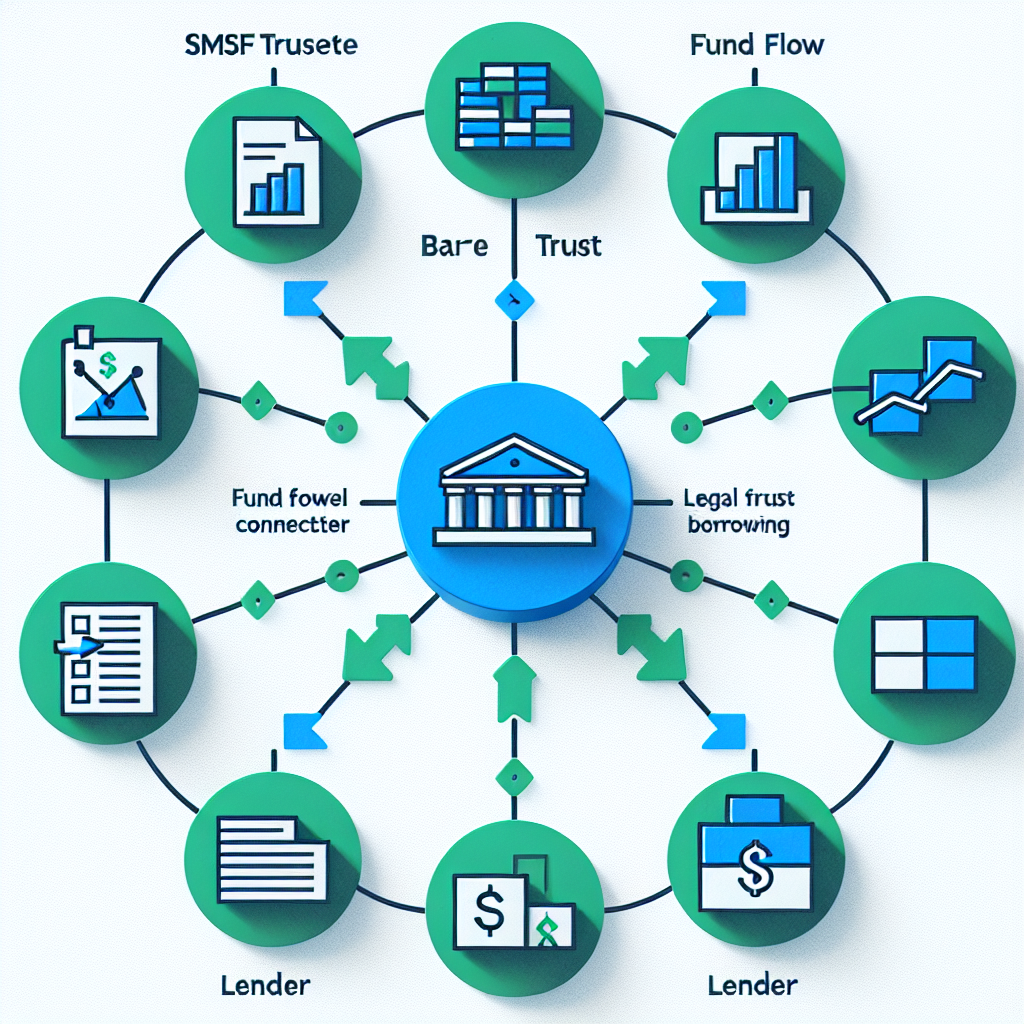

What makes SMSF borrowing particularly distinctive is that these loans operate under Limited Recourse Borrowing Arrangements (LRBAs). This means the lender’s rights are restricted to the specific asset being purchased, providing an additional layer of protection for your other SMSF assets.

“All trustees of your SMSF are responsible for running the fund and making decisions that are in the best financial interests of all members,” notes the Australian Taxation Office. This responsibility extends to borrowing decisions, making it essential to have accurate information about your fund’s borrowing capacity before proceeding with property investments.

How SMSF Borrowing Power Calculators Work: Simplifying Complex Financial Calculations

The typical process of using an SMSF borrowing power calculator involves:

Inputting Fund Details: You’ll provide information about your current SMSF balance, existing assets, and any current liabilities.

Contribution Information: The calculator will request details about ongoing member contributions, including frequency and amount.

Income Streams: You’ll need to enter data about income-generating assets within the fund, such as interest, dividends, or rental income from existing properties.

Expense Considerations: The calculator factors in the fund’s ongoing expenses, including administration costs and any existing loan repayments.

Property Investment Goals: Finally, you’ll input details about the type of property you’re interested in purchasing and its potential rental yield.

The calculator then processes this information through algorithms that mirror lenders’ assessment criteria, providing you with an estimated borrowing capacity that aligns with current market conditions and lending policies.

The convenience of these calculators cannot be overstated. Traditional bank applications for SMSF loans can be time-consuming and often require extensive documentation before you even know if your investment goals are feasible. In contrast, an SMSF borrowing power calculator provides immediate insights, allowing you to adjust your investment strategy based on realistic borrowing expectations.

For example, if you discover your SMSF has a borrowing capacity of $750,000, you can immediately begin researching properties within that price range, rather than wasting time investigating options that may be beyond your fund’s reach.

Benefits of Using an SMSF Borrowing Power Calculator for Property Investment Decisions

1. Informed Decision-Making

Knowledge is power in investment planning. By understanding exactly what your SMSF can borrow, you can make targeted property searches that align with your financial reality. This prevents the disappointment of finding an ideal property only to discover it’s beyond your borrowing capacity.

2. Strategic Investment Planning

With clear borrowing limits established, trustees can develop more effective long-term investment strategies. For instance, if your current borrowing capacity falls short of your investment goals, you might implement strategies to increase member contributions or restructure existing investments to improve the fund’s financial position.

3. Time Efficiency

“Calculate your SMSF borrowing capacity. Fill out your information, and we can estimate your maximum SMSF borrowing capacity on an investment property,” explains one financial service provider. This efficiency saves valuable time compared to formal loan applications, allowing trustees to focus on finding suitable properties rather than navigating complex loan assessments.

4. Alignment with Investment Strategy

Every SMSF must have a documented investment strategy that outlines how the fund will meet the retirement objectives of its members. A borrowing power calculator helps ensure that property investment decisions align with this strategy by providing realistic parameters for property selection.

5. Reduced Application Rejections

By knowing your borrowing capacity in advance, you can avoid submitting loan applications that are likely to be rejected. This not only saves time but also prevents potential negative impacts on your fund’s financial record.

6. Enhanced Negotiation Position

Armed with precise knowledge of your borrowing capacity, you enter property negotiations with confidence. This can be particularly valuable in competitive markets where quick decisions may be necessary to secure desirable properties.

As one property investment specialist notes, “Regular rental income from property investments can provide a steady cash flow, which can be particularly advantageous during the accumulation phase of the SMSF.” Understanding your borrowing power helps you maximize this potential benefit by selecting properties with optimal rental yields relative to purchase price.

External Factors Influencing Your SMSF Borrowing Power

Lender Requirements and Policies

Different lenders have varying policies regarding SMSF loans. Some key considerations include:

Loan-to-Value Ratio (LVR): Most lenders cap SMSF loans at 70-80% of the property value, compared to up to 95% for personal home loans. This means your fund needs a larger deposit than might be required for personal property investments.

Interest Rates: SMSF loans typically carry higher interest rates than standard mortgages, reflecting the specialized nature of these lending arrangements. These higher rates affect serviceability calculations and, consequently, borrowing power.

Liquidity Requirements: Lenders often require SMSFs to maintain specific liquidity levels to ensure ongoing loan serviceability, particularly if members are approaching retirement age.

Fund Age and History: Newer SMSFs may face more stringent lending criteria than established funds with longer financial histories.

Regulatory Considerations

The regulatory environment for SMSF borrowing continues to evolve, with potential impacts on borrowing capacity:

“As the government seeks to get its controversial super tax over the line, the Self Managed Super Fund borrowing sector will be under fresh pressure,” notes one industry observer. These regulatory changes can affect lending policies and, by extension, your fund’s borrowing power.

Property Type Restrictions

Not all properties are eligible for SMSF investment under borrowing arrangements:

“SMSF property investments are limited to single contract properties. SMSFs cannot invest in properties requiring construction loans,” explains one industry source. This restriction can impact your investment options and should be considered when planning your strategy.

Liquidity Testing

Lenders apply strict liquidity tests to ensure your SMSF can meet loan repayments even in challenging circumstances:

Member Retirement: If fund members are approaching retirement age, lenders will assess whether the fund can continue servicing the loan when contribution inflows potentially decrease.

Market Downturns: Your fund may need to demonstrate capacity to maintain repayments during periods of reduced rental income or investment returns.

Expense Increases: The ability to cover rising costs while maintaining loan repayments is another critical consideration in liquidity assessments.

Understanding these external factors allows trustees to use borrowing power calculators more effectively, making adjustments to account for specific lender requirements or regulatory considerations that might not be fully captured in general calculations.

Maximizing Your SMSF’s Property Investment Potential Through Strategic Planning

Contribution Optimization

Strategic planning of member contributions can significantly enhance borrowing capacity. By maximizing concessional and non-concessional contributions within allowable limits, trustees can strengthen their fund’s financial position and increase borrowing power.

Portfolio Diversification

While property may be your target investment, maintaining a diversified portfolio can improve your fund’s overall financial health and borrowing capacity. As one expert notes, “An SMSF investment strategy is a plan designed to manage the assets of a Self Managed Super Fund to ensure steady growth and compliance with Australian regulations.”

Tax Efficiency

“An SMSF can claim interest and borrowing expenses on an investment property in exactly the same way as an individual investor. So you can use negative gearing to offset losses against other income in the fund,” explains one tax specialist. Strategic use of these tax advantages for SMSF property investments can improve cash flow and enhance borrowing capacity.

Property Selection Strategy

“New properties allow you to claim depreciation on both the building and fixtures, significantly lowering taxable income and enhancing your fund’s cash flow,” notes a property investment advisor. This improved cash flow can positively impact borrowing power calculations.

Professional Guidance

Working with financial advisors who specialize in SMSF property investment can provide valuable insights beyond what calculators offer. These professionals can help you navigate the complexities of SMSF borrowing and develop strategies tailored to your specific circumstances.

Conclusion: Leveraging Technology for Smarter SMSF Property Investment

The journey to successful SMSF property investment begins with understanding your fund’s true borrowing potential. An SMSF borrowing power calculator serves as an essential first step in this process, providing the clarity needed to make informed investment decisions.

By leveraging this technological tool alongside professional advice, SMSF trustees can uncover their fund’s hidden property investment potential and develop strategies that maximize retirement benefits. The combination of accurate borrowing power assessment and strategic planning creates a powerful framework for SMSF property investment success.

As you navigate the complexities of SMSF property investment, remember that knowledge is your greatest asset. Understanding your borrowing capacity isn’t just about knowing how much you can spend – it’s about gaining the confidence to make property investment decisions that align with your fund’s objectives and your members’ retirement goals.

With the right tools, information, and strategic approach, your SMSF can become a powerful vehicle for property investment, potentially delivering significant benefits for members’ retirement futures. The journey begins with a simple question: “What is my SMSF’s borrowing power?” The answer could unlock investment potential you never knew existed.