Ever found yourself doom-scrolling through Reddit at 1 AM, only to stumble upon surprisingly solid financial advice? You’re not alone. While most of us associate late-night internet browsing with cat videos and meme rabbit holes, many Australian investors have discovered a goldmine of retirement planning wisdom in an unexpected place – Reddit’s bustling SMSF communities.

“I initially went on Reddit looking for gardening tips,” shares one SMSF trustee who preferred to remain anonymous. “Two hours later, I was taking notes on diversification strategies for my self managed super fund. My partner thought I’d lost the plot!”

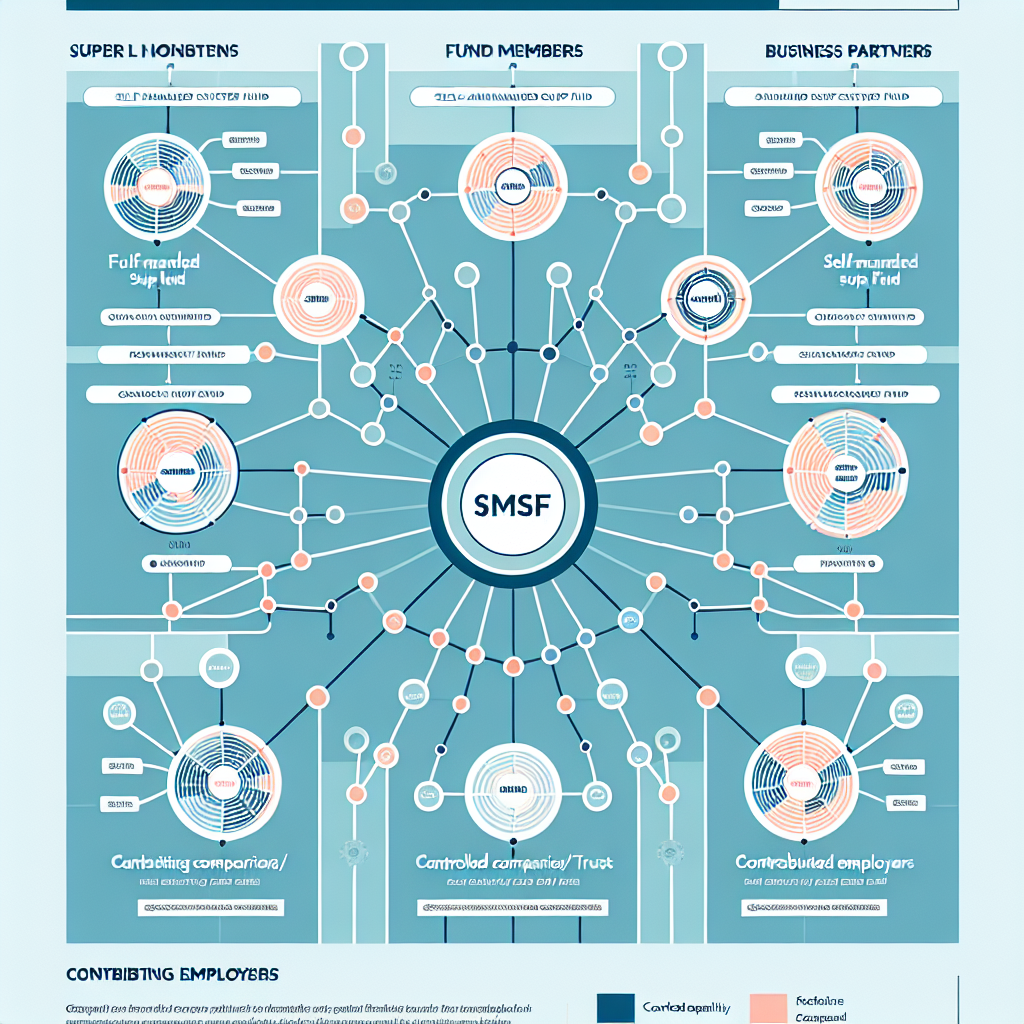

Self Managed Super Funds (SMSFs) represent the DIY approach to superannuation, giving trustees direct control over their retirement savings rather than letting traditional super funds make all the decisions. With over 600,000 SMSFs operating in Australia, managing more than $750 billion in assets, it’s no wonder conversations about these financial vehicles have spilled into online forums like Reddit.

📊 SMSF Facts:

SMSFs now represent approximately one-third of Australia’s total superannuation assets, making them a significant component of the retirement landscape.

The Reddit SMSF Underground: A Treasure Trove for Investors

For the uninitiated, Reddit functions as a massive collection of forums (called subreddits) where people discuss specific topics. While there isn’t a dedicated Australian SMSF subreddit, discussions about self managed super fund investments frequently appear in communities like r/AusFinance, r/fiaustralia, and r/ASX_Bets.

What makes these self managed super fund Reddit discussions valuable is their unfiltered nature. Unlike polished financial websites or advice from institutions with products to sell, Reddit offers raw, firsthand accounts from everyday Australians navigating the SMSF landscape.

“Reading through self managed super fund Reddit threads was eye-opening,” says Michael, a 42-year-old business owner who established his SMSF last year. “You get to see both success stories and horror stories, which gives you a more balanced view than what you typically hear from financial advisors who might be incentivized to promote certain products.”

Popular topics on self managed super fund Reddit discussions include:

Cryptocurrency in SMSFs

Cryptocurrency investments within SMSFs generate significant discussion on Reddit. One popular thread titled “Anyone successfully investing in crypto through their SMSF?” garnered over 200 comments from trustees sharing their experiences.

“However, crypto investments within an SMSF require careful management due to regulatory and compliance requirements and also cost money to maintain,” cautioned one Reddit user. Others detailed their experiences setting up specialized SMSF structures to accommodate digital assets while maintaining compliance.

Property Investment Strategies

Real estate remains a cornerstone investment for many SMSF trustees, and Reddit offers a platform for discussing the nitty-gritty details rarely covered in mainstream financial media.

One Reddit user shared: “A good rule to live by is that whenever an investment is brought to you rather than found by you, look out! Your net yield on the property is under 2.5% so I would definitely look elsewhere.” This kind of practical advice from fellow investors helps trustees avoid common pitfalls.

Fee Comparisons and Provider Reviews

SMSF management costs are frequently discussed, with users comparing different administrative services and platforms.

“StakeSMSF can beat all the industry super options if the balance is higher than ~$475,000 using a A200/BGBL portfolio,” noted one Reddit user, highlighting how fee structures impact different investment approaches. Another added, “With options like E superfund and similar, fees and admin costs are low now.“

Expert Insights from the Reddit Community

While Reddit has a reputation for memes and casual conversation, financial subreddits often feature contributions from qualified professionals and experienced investors. These self managed super fund Reddit discussions provide valuable insights on complex topics:

Legislative Understanding

The regulatory framework governing SMSFs is complex and constantly evolving. Reddit discussions often break down these changes in accessible language.

“Administration costs of a SMSF are huge and you need a professional to manage the compliance aspects. Unless you can invest over 250k it’s not really worth it,” advised one user in a thread about SMSF suitability. This straightforward assessment helps potential trustees understand the practical threshold for making an SMSF worthwhile.

Governance and Compliance Warnings

SMSF trustees face significant responsibilities, and Reddit users frequently share compliance warnings based on personal experiences or professional knowledge.

“Failing to adhere to SMSF regulations can lead to severe penalties, disqualification of trustees, and even the loss of tax concessions,” warned one user, highlighting the serious consequences of mismanagement. These real-world cautions serve as important reminders of trustee obligations.

A financial advisor participating in an AMA (Ask Me Anything) session explained: “You’ll have an annual audit and they will require all the paperwork for everything. Stay organized from day one, or you’ll regret it when audit time comes around.“

Tax Optimization Strategies

Tax efficiency represents one of the primary advantages of SMSFs, and Reddit discussions frequently explore legitimate strategies for maximizing these benefits.

“For 2 people it’s probably worthwhile. You pay for an SMSF once and it covers 2 people. You can then avoid issues like pooled funds, and you can have more control over when to buy and sell to manage your tax situation,” explained one user, highlighting the family planning aspects of SMSFs.

Common Concerns and Red Flags

The anonymous nature of Reddit allows users to discuss sensitive topics they might avoid in professional settings, including warning signs and scams:

Investment Scams Targeting SMSF Trustees

Several Reddit threads have highlighted scams specifically targeting SMSF trustees, with users sharing warning signs they’ve encountered.

“Criminals posing as advisers convincing fund members to transfer their super fund balances to them under the guise of setting up a self-managed super fund,” warned one user, describing a scheme they nearly fell victim to. These firsthand accounts help other trustees recognize potential threats.

Another red flag mentioned frequently involves unsolicited investment opportunities promising unrealistic returns: “Self Employed Retirement Plan ✌【Part-Time Position】✌Start with $100 and let our expert-managed funds drive your profits up to 100% monthly!” Multiple Reddit users flagged this as a classic SMSF scam approach.

⚠️ Warning:

If an investment opportunity promises unrealistic returns with minimal effort, it’s almost certainly a scam. Legitimate SMSF investments rarely require urgent action or offer guaranteed high returns.

Diversification Debates

Risk management generates passionate discussion, with experienced investors often cautioning against concentration in single asset classes.

“I am planning to get into SMSF and invest in VGS/VAS(75/20) rest in liquid assets,” shared one new trustee, prompting extensive feedback about diversification strategies. The resulting conversation highlighted different approaches to balancing growth and security within an SMSF.

Real Cost Considerations

Perhaps the most valuable aspect of self managed super fund Reddit discussions involves transparent conversations about the true costs of SMSF management.

“SMSF’s can justify themselves on cost grounds alone if you use a low cost provider, if you have a reasonable balance, & if you are already an experienced investor,” explained one user. This practical assessment helps potential trustees make informed decisions about whether an SMSF aligns with their financial situation.

The Community Advantage: Why Reddit Matters for SMSF Trustees

Beyond specific advice, what makes self managed super fund Reddit discussions truly valuable is the community aspect. Here’s why engagement with this online community benefits SMSF trustees:

Peer Support During Market Volatility

When markets experience turbulence, Reddit becomes a valuable support network for trustees navigating uncertain conditions.

During recent market downturns, SMSF-related threads filled with trustees sharing coping strategies and long-term perspectives. This peer support helps trustees maintain discipline during challenging periods when emotional reactions might otherwise lead to poor decisions.

Practical Implementation Guidance

While financial advisors provide theoretical frameworks, Reddit offers practical “how-to” guidance from those who have already completed specific processes.

“As per title, does anyone actively manage their investments using products such as Stake SMSF, including US shares?” asked one user, generating detailed responses about international investment implementation. These step-by-step insights help trustees translate theory into action.

Diverse Perspectives

Perhaps most importantly, Reddit exposes trustees to diverse investment philosophies and approaches they might not encounter in their personal networks.

“The low cost SMSF might be a good option to provide more control over our investments, but didn’t want to go all in if the fees erode the value,” shared one cautious investor, while another countered, “SMSF is the best option for everyone these days.” This contrast of viewpoints helps trustees develop nuanced perspectives on complex issues.

Aligning Online Wisdom with Sound Financial Principles

At Aries Financial, we recognize the value of community knowledge sharing. However, we also emphasize the importance of filtering this information through proven financial principles. The best approach combines the practical insights found in self managed super fund Reddit discussions with structured professional guidance.

The real power comes from combining community wisdom with expert knowledge. Just as a doctor might appreciate hearing about your research while still providing professional diagnosis, financial experts can work more effectively with informed trustees who bring their own knowledge to the table.

This balance between self-education and professional guidance aligns perfectly with our philosophy of empowerment through knowledge. We believe informed trustees make better decisions, whether that information comes from formal education, personal research, or yes – even late-night Reddit browsing.

Conclusion: The Unexpected Value of Self Managed Super Fund Reddit Discussions

Who would have thought that between cat memes and hobby discussions, Reddit would emerge as a valuable resource for SMSF trustees? Yet the platform’s combination of anonymity, community expertise, and direct experience sharing creates a unique environment where investors can gain insights difficult to find elsewhere.

For SMSF trustees looking to expand their knowledge base, engaging with these online communities offers significant benefits – provided you approach the information with appropriate critical thinking. Not every Reddit comment deserves equal weight, but the collective wisdom of experienced investors can supplement professional advice in meaningful ways.

💡 Pro Tip:

When browsing Reddit for SMSF advice, focus on communities like r/AusFinance where verified professionals often contribute quality insights.

The next time you find yourself scrolling through financial forums at odd hours, remember – you’re not just procrastinating. You’re participating in a modern form of financial education that, when balanced with professional guidance, can significantly strengthen your retirement planning approach.

And that’s something even your financial advisor might approve of – though perhaps not at 1 AM.