Self-Managed Super Fund (SMSF) trustees looking to grow their retirement savings through property investment have a powerful tool at their disposal: Limited Recourse Borrowing Arrangements (LRBAs). This specialized lending structure allows your SMSF to purchase property using borrowed funds while maintaining compliance with strict superannuation laws. However, the complexity of SMSF borrowing for property means one wrong step could jeopardize your entire fund’s compliance status.

Understanding how LRBAs work isn’t just about ticking boxes. It’s about making informed decisions that protect your retirement savings while maximizing investment potential. At Aries Financial, we believe in empowering SMSF trustees with the knowledge they need to navigate these waters confidently. This comprehensive guide walks you through everything you need to know before your SMSF borrows to invest in property.

Understanding Limited Recourse Borrowing Arrangements

A Limited Recourse Borrowing Arrangement is the legal mechanism that makes SMSF borrowing for property possible. Before 2007, SMSFs were prohibited from borrowing entirely. Today, LRBAs provide a carefully regulated pathway for trustees to leverage their superannuation funds for property acquisition.

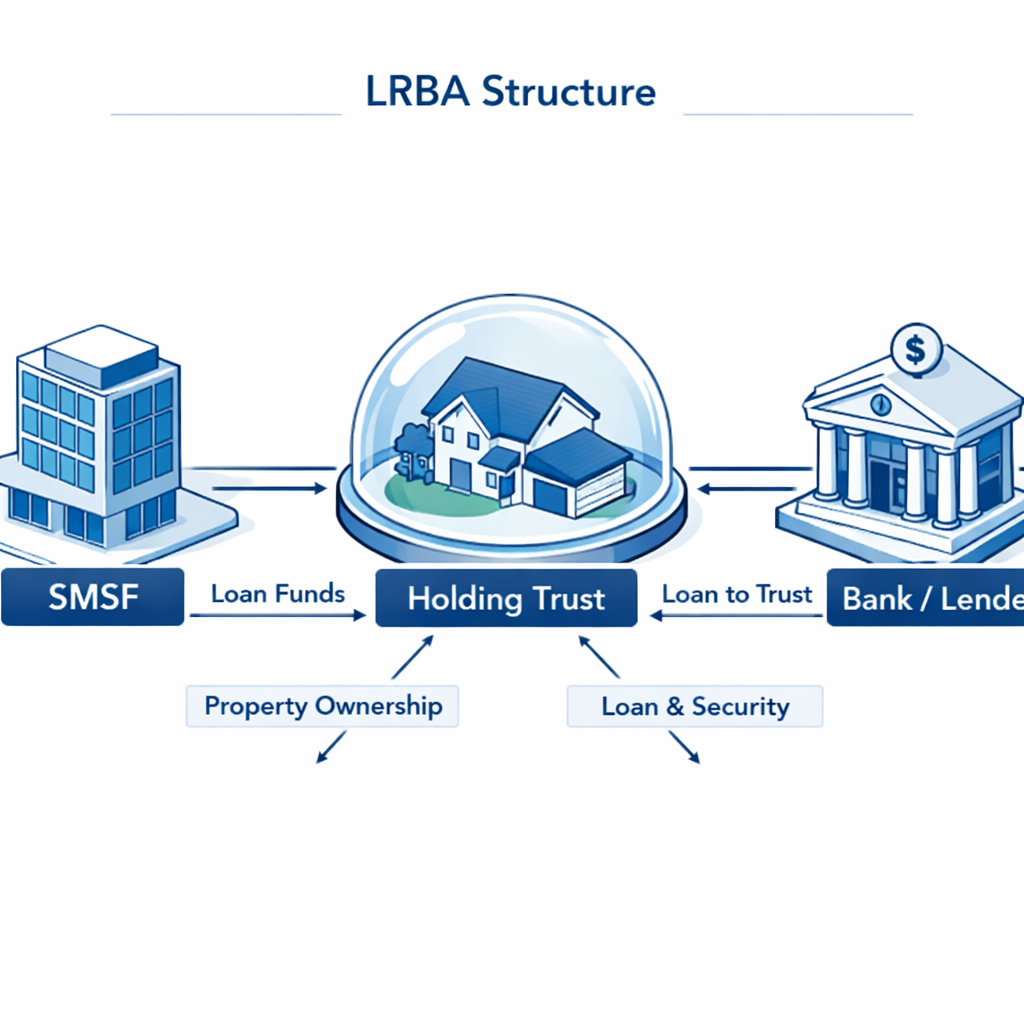

Here’s how it works: Your SMSF borrows money to purchase an investment property, but the property isn’t held directly in the SMSF’s name during the loan period. Instead, it’s held in a separate entity called a bare trust or holding trust. Your SMSF holds the beneficial interest in the property, meaning it receives all rental income and capital gains, but legal ownership sits with the holding trust until the loan is fully repaid.

This structure exists to protect both the lender and your SMSF. The holding trust creates a clear separation between the borrowed asset and your fund’s other assets. If something goes wrong and the SMSF cannot repay the loan, the lender’s recourse is limited to the specific property purchased with those borrowed funds. Your other SMSF assets—shares, cash, other properties—remain protected. This “limited recourse” nature is what makes the arrangement compliant with superannuation law.

The LRBA Structure Explained

The LRBA structure involves three key parties working together. First, there’s your SMSF, which combines its existing funds with borrowed money to purchase the property. Second, there’s the holding trust, which holds legal title to the property on behalf of your SMSF. Third, there’s the lender, who provides the loan under strict arm’s length terms.

When your SMSF enters into an LRBA, it contributes a deposit (typically 20-30% of the property’s purchase price) while the lender provides the balance. The property title goes into the holding trust’s name, but your SMSF maintains beneficial ownership. This means your fund receives all rental income, pays all expenses, and ultimately benefits from any capital appreciation.

The beauty of this structure lies in its protective nature. Because the loan is limited recourse, if property values fall or rental income doesn’t cover loan repayments, the lender cannot pursue your SMSF’s other assets. They can only take possession of the specific property securing the loan. This protection is fundamental to maintaining compliance with the sole purpose test—ensuring your SMSF exists solely to provide retirement benefits.

Once the loan is fully repaid, legal title transfers from the holding trust directly into your SMSF’s name. At this point, your fund owns the property outright, and it becomes just another asset within your diversified portfolio.

Eligible Assets Under LRBA

Not every asset qualifies for SMSF borrowing. The law is specific about what your fund can acquire through an LRBA. The most common eligible asset is direct real property—residential homes, commercial buildings, or vacant land. These properties must be single acquirable assets, meaning you cannot use one LRBA to purchase multiple separate properties.

Unit trusts holding a single property also qualify as eligible assets. However, the trust must hold only one acquirable asset, and that asset must meet the same rules as if purchased directly.

Here’s a critical rule that trips up many trustees: acquisition rules strictly prohibit using an LRBA to purchase assets your SMSF already owns. The borrowed funds must acquire a new asset or a replacement asset, not refinance an existing SMSF holding. For example, if your SMSF already owns an investment property outright, you cannot use an LRBA to borrow against that property to free up cash. The borrowing must be for acquiring a fresh asset.

Similarly, you cannot use an LRBA to purchase an asset from a related party (except in very specific circumstances involving business real property). This means buying your family home and renting it back to yourself is strictly off-limits. The property must be purchased from an unrelated third party at market value, under arm’s length terms.

Understanding In-House Asset Rules

SMSF regulations include an in-house asset cap of 5%, designed to prevent funds from becoming too concentrated in related-party investments. In-house assets typically include loans to related parties, investments in related trusts, or shares in related companies. Exceeding this 5% threshold triggers significant compliance issues and potential penalties.

Here’s where LRBA arrangements provide an important exception. Properties held under an LRBA do not count toward your fund’s in-house asset cap, even though they’re held in a related trust structure (the holding trust). This exception exists because the holding trust is a bare trust with no active role beyond holding legal title. It doesn’t generate income independently or conduct business—it simply holds the property until your SMSF repays the loan.

This exception makes LRBAs particularly attractive for property investment. Your SMSF can borrow significant amounts to purchase substantial properties without worrying about breaching in-house asset caps. However, this doesn’t mean you can ignore the cap entirely. Any other related-party investments within your SMSF still count toward the 5% limit.

Understanding this distinction helps trustees maximize investment opportunities while maintaining compliance. At Aries Financial, we’ve seen too many trustees stumble over these technicalities. Our expertise in SMSF lending compliance ensures you structure your borrowing correctly from day one.

Key Compliance and Governance Requirements

Compliance with LRBA rules demands meticulous attention to detail. Every aspect of your borrowing arrangement must meet arm’s length standards—meaning the terms, conditions, and costs must reflect what unrelated parties would negotiate in similar circumstances.

Your loan agreement must document everything: interest rates, repayment schedules, security arrangements, and default provisions. These terms cannot favor your SMSF over what a commercial lender would reasonably offer. For instance, charging an unrealistically low interest rate could trigger non-arm’s length income (NALI) provisions, causing rental income to be taxed at the top marginal rate instead of the concessional 15%.

Proper documentation extends beyond the loan agreement. You need a trust deed for your SMSF, a bare trust deed for the holding trust, and detailed minutes documenting every trustee decision. These records prove your fund’s decisions align with its investment strategy and comply with superannuation law.

Regular property valuations are equally important. Your SMSF must value all assets at market rates annually. For properties under LRBA, this means obtaining professional valuations regularly to ensure your financial statements accurately reflect asset values. Undervaluing or overvaluing properties can create compliance issues during your annual audit.

Speaking of audits, every SMSF must undergo an independent audit annually. Your auditor examines financial statements and compliance with superannuation law. They’ll scrutinize your LRBA structure, loan terms, property valuations, and documentation. Keeping accurate records throughout the year makes this process smoother and demonstrates your commitment to proper governance.

Tax and Financial Implications of LRBAs

Understanding the tax implications of SMSF borrowing for property helps you make informed decisions about your investment strategy. Interest payments on your LRBA loan are generally tax-deductible, reducing your fund’s taxable income. This deduction applies against rental income and, in some cases, capital gains.

Rental income from your investment property is taxed at 15% during the accumulation phase (before retirement). Once your SMSF enters pension phase, rental income becomes tax-free. This tax treatment makes property investment through SMSFs particularly attractive for long-term wealth building.

Capital gains tax (CGT) considerations are equally important. If your SMSF sells a property held for more than 12 months, it receives a one-third CGT discount, meaning only two-thirds of the gain is taxable. During accumulation phase, this discounted gain is taxed at 15%—effectively 10% of the total gain. In pension phase, capital gains are tax-free entirely.

However, leverage amplifies both gains and losses. Borrowing to invest means positive returns are magnified, but negative returns hurt more. If property values decline while you’re carrying debt, your SMSF’s equity position deteriorates faster than if you owned the property outright. This amplification effect requires careful cash flow planning.

Ensure your SMSF maintains sufficient liquidity to cover loan repayments, property expenses, and member benefits. Running short on cash could force asset sales at inopportune times or prevent your fund from meeting minimum pension payment requirements.

Risks and Considerations

LRBA compliance complexity represents a significant risk for trustees. The rules governing SMSF borrowing are intricate, and mistakes can be costly. Breaching borrowing rules could result in your entire fund losing its compliant status, triggering massive tax penalties. This isn’t about minor fines—it could mean your entire fund being taxed at the top marginal rate.

Cash flow sensitivity is another major consideration. Unlike discretionary investments you can defer, loan repayments are mandatory. Your SMSF must generate sufficient income to meet these obligations regardless of market conditions. If rental income falls short, your fund needs alternative income sources or reserves to cover the gap.

Property markets are cyclical, and values can decline. While limited recourse protects your other SMSF assets, watching a property’s value drop below the loan amount is never pleasant. Negative equity doesn’t directly harm your retirement savings, but it limits your strategic flexibility and could lock your fund into an underperforming asset.

Regulatory changes present ongoing risks. Governments periodically review superannuation rules, and LRBAs have faced scrutiny in recent years. While no immediate changes are on the horizon, trustees should stay informed about potential regulatory shifts that could impact borrowing arrangements.

Practical Steps and Best Practices

Before diving into SMSF borrowing for property, confirm your eligibility. Check your SMSF’s trust deed to ensure it permits borrowing. Many older deeds were drafted before LRBAs became common and may need updating. Verify your investment strategy includes property investment and borrowing as acceptable approaches.

Setting up the proper trust structure is critical. Engage experienced professionals to establish your holding trust correctly. The bare trust deed must comply with specific legal requirements, and any errors could invalidate the entire arrangement. This isn’t an area for DIY approaches or cutting corners.

Ensure your loan terms meet arm’s length standards. At Aries Financial, we specialize in providing competitive SMSF loan solutions starting from 5.99% PI, with fast approvals within 1-3 business days. Our expertise in SMSF lending compliance means you can trust your loan structure will withstand ATO scrutiny.

Seek expert advice throughout the process. SMSF specialists, property advisors, and financial planners can help you navigate complex compliance requirements while optimizing your investment strategy. The cost of professional advice is minimal compared to the potential consequences of getting it wrong.

Maintain ongoing compliance through regular reviews. Annual audits, updated valuations, documented trustee meetings, and accurate financial records aren’t optional—they’re fundamental to protecting your retirement savings.

Your LRBA Compliance Checklist

Before proceeding with SMSF borrowing for property, work through this essential checklist:

Asset Qualifications: Confirm the property is a single acquirable asset, purchased from an unrelated party at market value. Verify it’s a new acquisition, not an existing SMSF holding.

Trust Setup: Establish a compliant bare trust to hold legal title. Ensure all documentation meets legal requirements and clearly defines the relationship between your SMSF and the holding trust.

In-House Cap Understanding: Verify your other related-party investments don’t exceed 5%. Understand that your LRBA property doesn’t count toward this cap, but other investments do.

Loan Terms: Ensure interest rates, repayment schedules, and loan conditions reflect arm’s length standards. Document everything thoroughly.

Tax Implications: Understand how rental income, interest deductions, and capital gains will affect your fund’s tax position during accumulation and pension phases.

Regular Compliance Activities: Schedule annual property valuations, maintain detailed records of all transactions, document trustee decisions in minutes, and prepare for annual audits.

Cash Flow Planning: Confirm your SMSF can sustain loan repayments from rental income and other sources. Build reserves for property vacancies or unexpected expenses.

Professional Support: Engage qualified professionals for legal, accounting, and lending expertise. Don’t navigate SMSF borrowing alone.

Making Informed Investment Decisions

SMSF borrowing for property offers tremendous opportunities for building retirement wealth, but only when structured correctly and managed diligently. The compliance requirements are demanding, but they exist to protect your retirement savings and ensure your fund operates with integrity.

At Aries Financial, our philosophy centers on integrity, expertise, and empowerment. We don’t just provide loans—we partner with SMSF trustees to ensure their borrowing arrangements are compliant, sustainable, and aligned with long-term retirement goals. Our specialized focus on SMSF lending means we understand the nuances that generalist lenders miss.

Whether you’re considering your first SMSF property investment or expanding an existing portfolio, the decisions you make today shape your retirement tomorrow. Take the time to understand LRBA structures thoroughly, seek expert guidance, and structure your borrowing for long-term success.

With competitive loan solutions starting from 5.99% PI and approval timelines of just 1-3 business days, Aries Financial makes professional SMSF lending accessible without compromising on compliance or quality. Our expertise ensures your investment strategy maximizes potential while maintaining the highest standards of regulatory compliance.

Your retirement savings deserve nothing less than complete confidence in every investment decision. By understanding LRBA compliance requirements and working with trusted specialists, you can leverage SMSF borrowing for property to build the retirement future you envision.