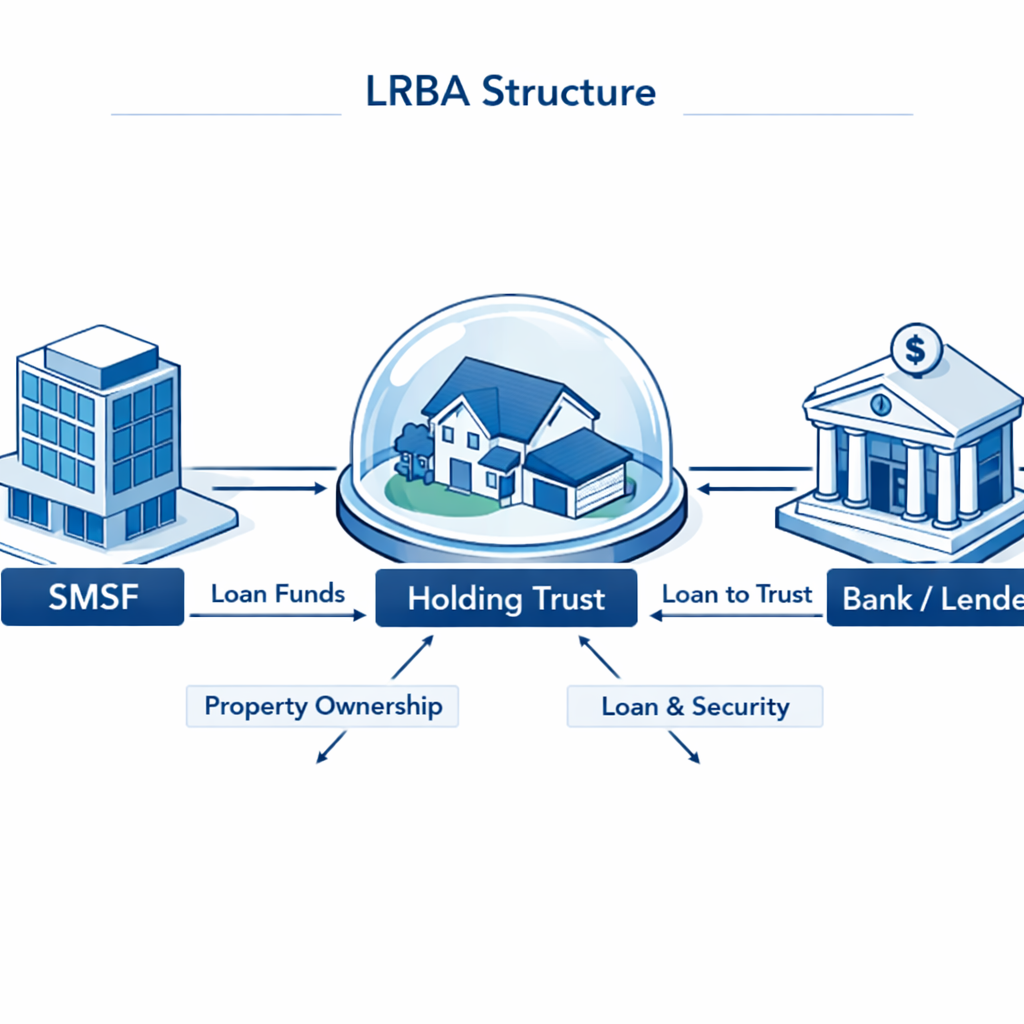

Navigate SMSF borrowing restrictions with confidence. Most trustees misunderstand the 10% rule—learn how it really applies to property loans, avoid costly in-house asset breaches, and structure compliant LRBAs that protect your retirement savings while maximizing growth opportunities.

#smsf borrowing restrictions

SMSF Borrowing Restrictions: The 10% Rule Most Trustees Get Wrong Read More »