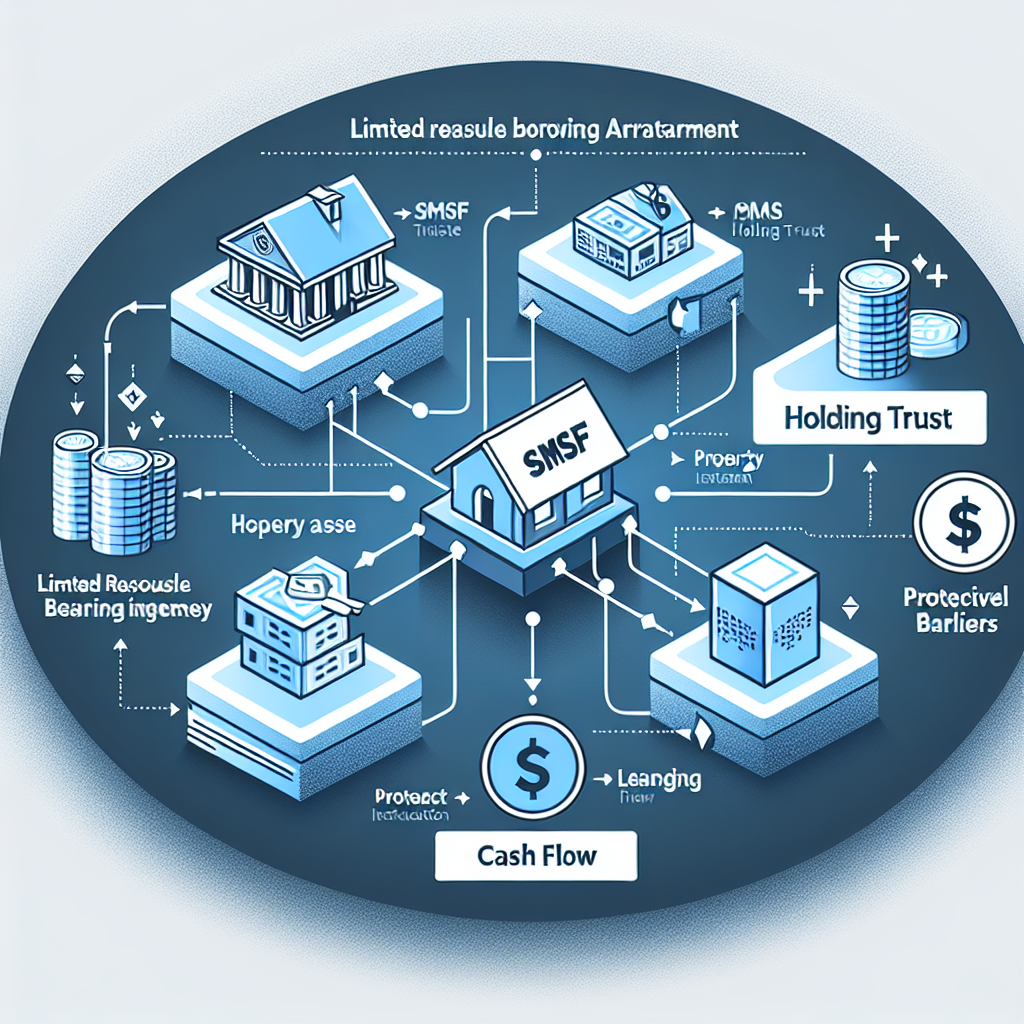

Are your LRBA interest rates draining your SMSF returns? With current rates between 7-8.14%, compared to 2.86% in 2022, your property investment could be costing thousands more yearly. Learn strategic approaches to maximize returns despite higher costs. #lrba interest rate

Looking for ways to secure the best SMSF home loan rates in today’s rising market? Our insider guide reveals how to navigate limited recourse borrowing arrangements, leverage your LVR for better deals, and implement strategic refinancing when rates are climbing. #best smsf home loan rates

Best SMSF Home Loan Rates: Insider Secrets to Unlock Premium Deals When Rates Are Soaring

Are rising SMSF LRBA interest rates threatening your retirement strategy? With rates jumping to 8.85% and heading to 9.35% next year, property investments within super need careful reassessment. Learn how to adapt your SMSF borrowing strategy in today’s challenging market. #smsf lrba interest rates

SMSF LRBA Interest Rates: Are Rising Costs Crushing Your Retirement Dreams? Read More »

SMSF LRBA Interest Rates: Are Rising Costs Crushing Your Retirement Dreams?

Comparing SMSF property loan rates between commercial and residential investments? Our analysis reveals critical differences that impact returns. Commercial rates start higher but offer greater yields, while residential provides stability with lower borrowing costs. Make informed choices for your retirement strategy. #smsf property loan rates

SMSF Property Loan Rates: The Hidden Gaps Between Commercial and Residential That Could Make or Break Your Retirement

Looking for the best returns on your SMSF investment? Compare current interest rates across industrial, retail, and office properties to maximize your retirement fund growth. Industrial properties currently lead with lower rates and higher yields for optimal SMSF performance. #smsf commercial property loan interest rates

SMSF Commercial Property Loan Interest Rates: Which Property Type Offers the Best Bang for Your Buck?

Are you paying too much for your retirement property investment? Current SMSF commercial property loan interest rates vary by 1.35% between lenders, potentially costing trustees up to $95,000 in unnecessary interest on a typical loan. Know your options. #SMSF Commercial Property Loan Interest Rates

SMSF Commercial Property Loan Interest Rates: Why Are Trustees Paying Too Much in 2025? Read More »

SMSF Commercial Property Loan Interest Rates: Why Are Trustees Paying Too Much in 2025?

Facing SMSF commercial property loan rates up to 9.71%? This premium over standard rates could cost $180,000+ in extra interest on a $750,000 loan. Discover how to navigate higher SMSF commercial property loan interest rates while protecting your retirement wealth. #SMSF Commercial Property Loan Interest Rates

SMSF Commercial Property Loan Interest Rates: The Hidden Tax Draining Your Retirement Wealth

Navigating the complex SMSF commercial property loan landscape? Many trustees are missing opportunities to secure better interest rates, potentially sacrificing thousands in retirement savings. Learn how property valuation, liquidity requirements, and strategic refinancing can dramatically improve your SMSF returns. #SMSF Commercial Property Loan Interest Rates

SMSF Commercial Property Loan Interest Rates: Are Trustees Leaving Money on the Table? Read More »

SMSF Commercial Property Loan Interest Rates: Are Trustees Leaving Money on the Table?

Navigating SMSF commercial property financing in 2025? Our latest analysis reveals hidden costs in loan structures that could impact your investment returns. Compare current rates ranging from 7.44-8.09% and discover strategic approaches to secure better terms for your fund. #SMSF Commercial Property Loan Interest Rates