Smart tech is revolutionizing SMSF planning—AI now delivers instant property analysis, personalized forecasts, and risk modeling that once took days. Discover how these tools enhance decision-making while maintaining compliance and security in your retirement strategy.

#AI #FinancialModeling #SMSF #Planning #Innovation

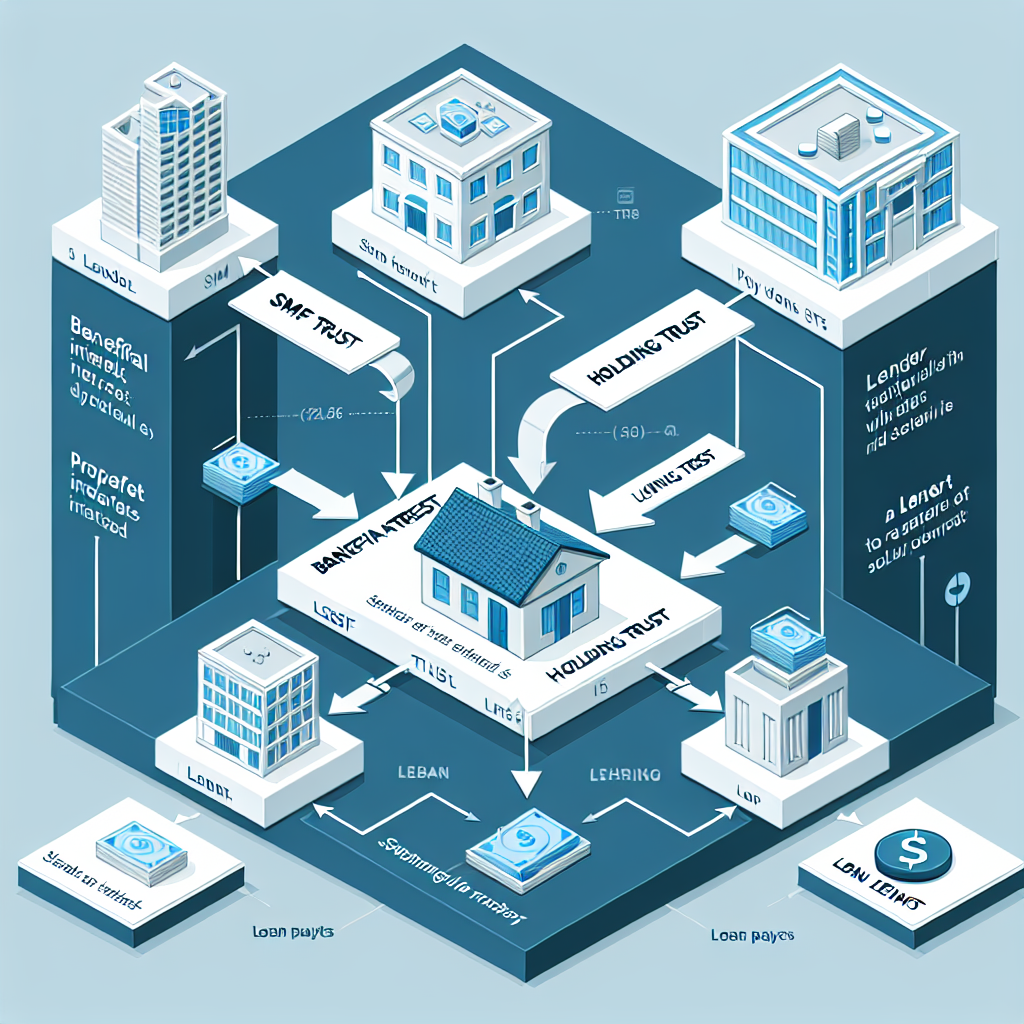

AI Financial Modeling: How Smart Tech Is Changing the Way You Plan Your SMSF Read More »