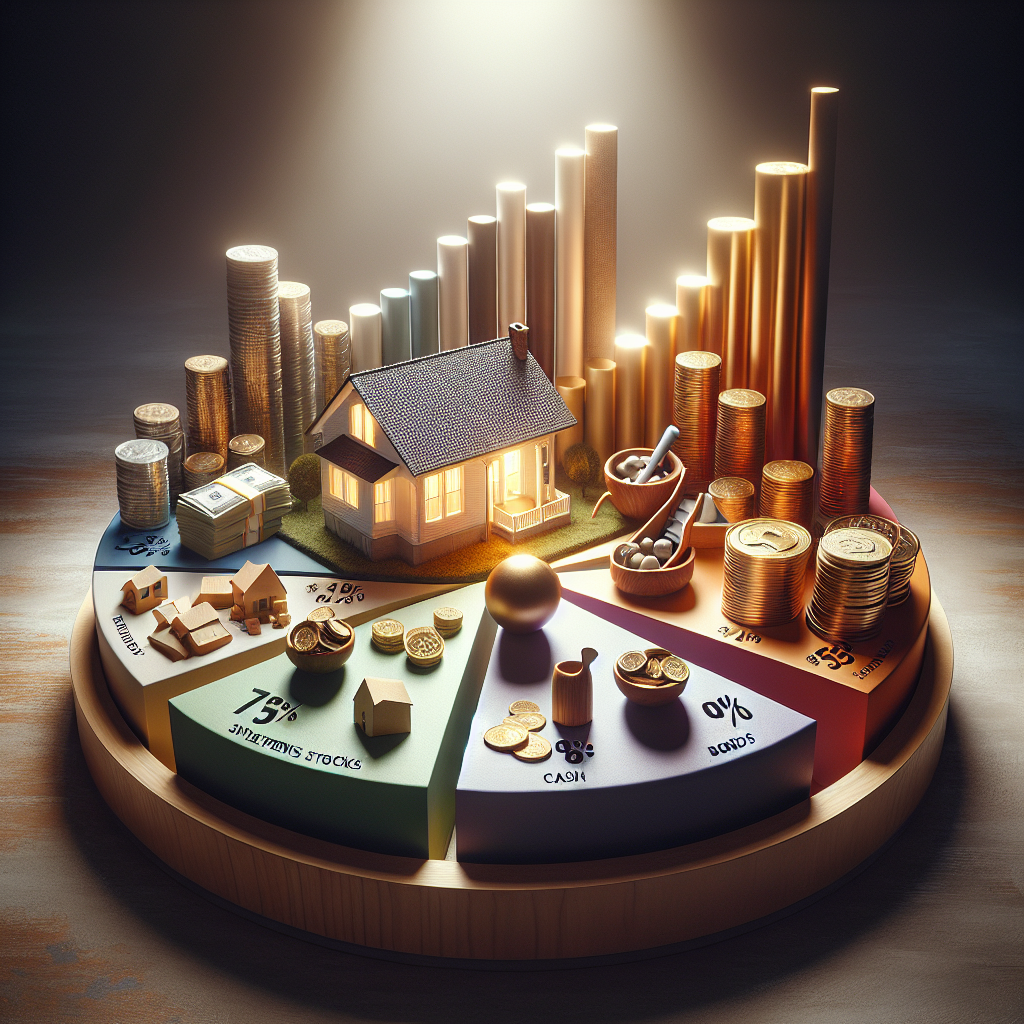

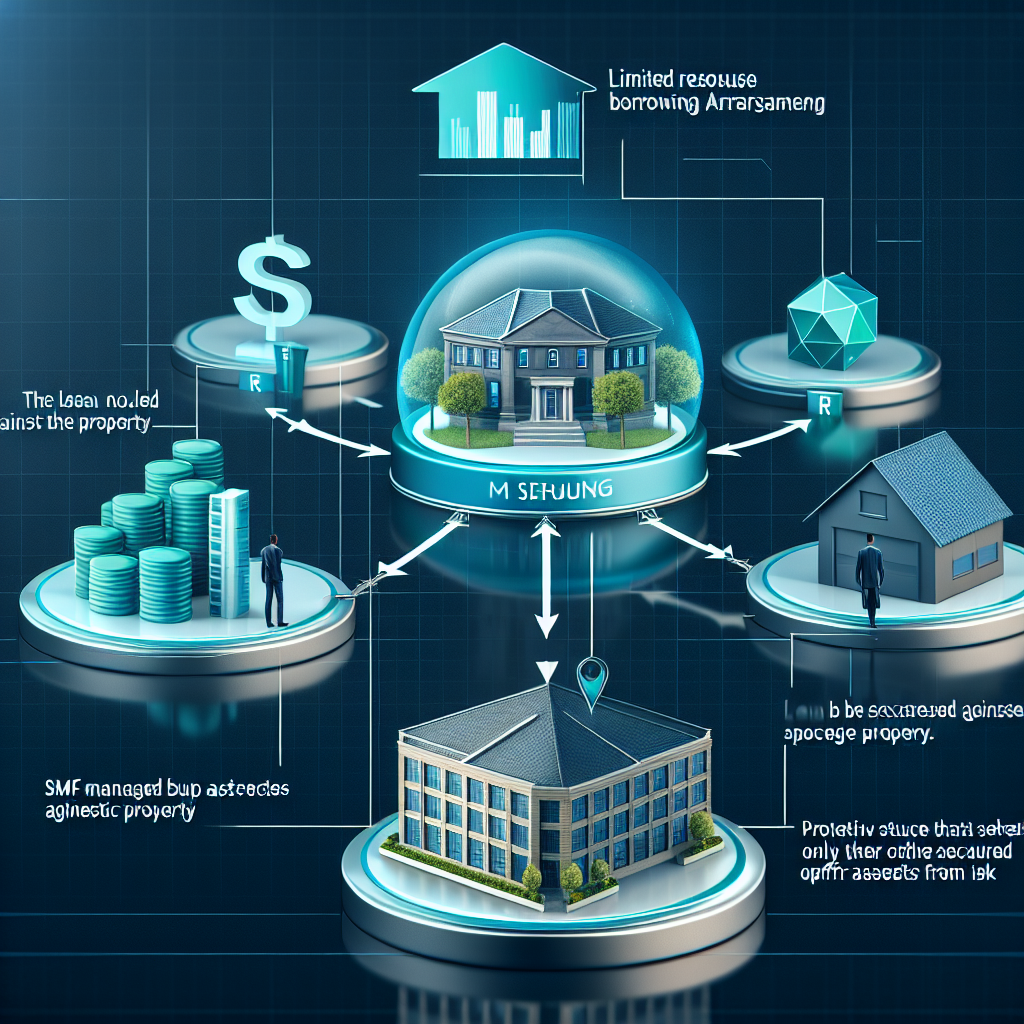

Avoid costly mistakes that could derail your retirement! Learn the pitfalls of improper diversification, compliance breaches, and poor market timing when investing in property through your super fund. Don’t risk your financial future! #SMSF property investment mistakes

7 SMSF Property Investment Mistakes That Could Cost You Your Retirement Read More »