When it comes to securing your financial future, few documents carry as much weight as your SMSF loan agreement. This seemingly mundane paperwork contains critical details that can dramatically impact your retirement outcomes – for better or worse. For SMSF trustees navigating the complex world of property investment through their super funds, understanding the fine print isn’t just good practice – it’s essential for compliance and financial success.

Many SMSF trustees rush through loan documentation, eager to secure that promising investment property. However, this haste can lead to costly oversights that compromise both regulatory compliance and investment returns. The Australian Taxation Office (ATO) maintains strict oversight of SMSF borrowing arrangements, making thorough understanding of your loan agreement not just advisable but necessary to avoid penalties and potential fund disruption.

Understanding SMSF Loan Agreements and LRBAs

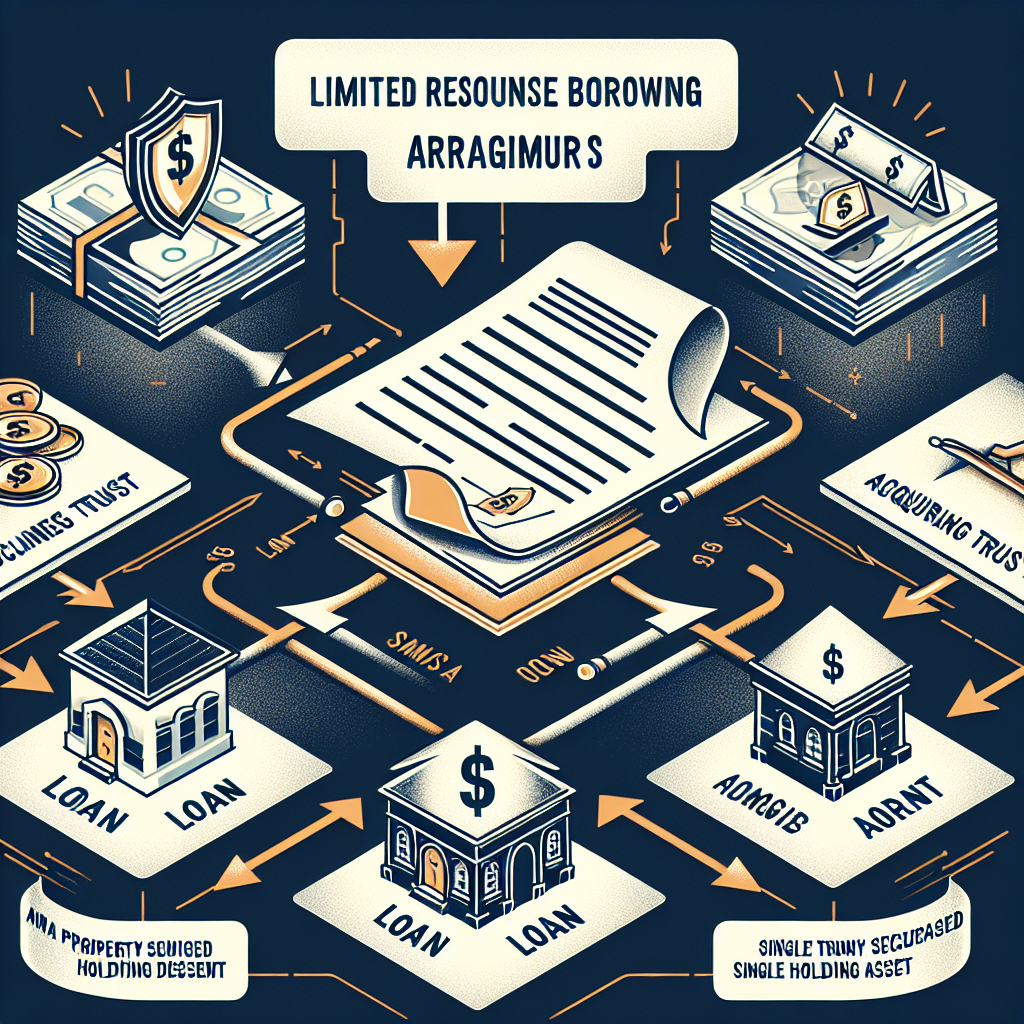

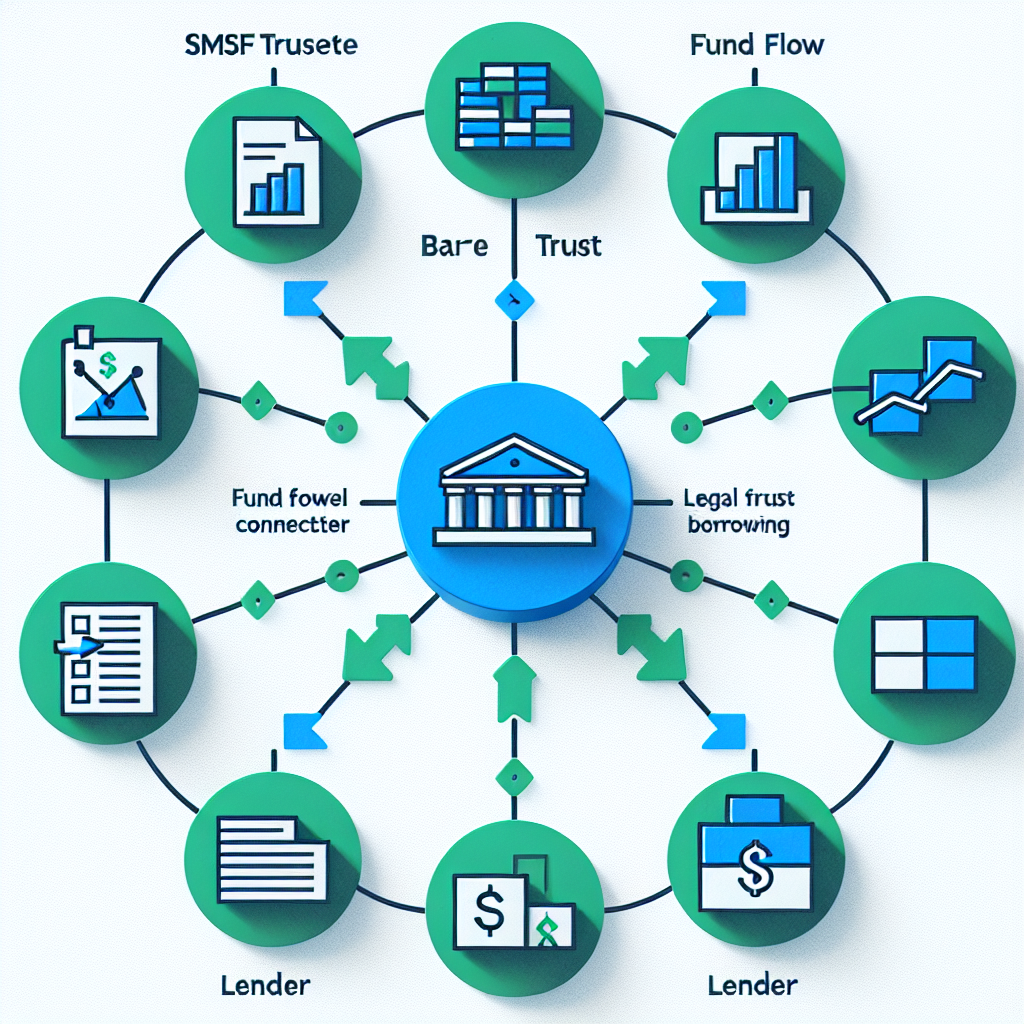

An SMSF loan agreement is a formal document that outlines the terms and conditions under which an SMSF borrows funds to purchase an asset – typically an investment property. This document serves as the cornerstone of what’s known as a Limited Recourse Borrowing Arrangement (LRBA), one of the few ways SMSFs are legally permitted to borrow money.

LRBAs were introduced to allow SMSFs to increase their investment potential while maintaining a level of protection against excessive risk. Under an LRBA, the asset being purchased is held in a separate trust, and if the SMSF defaults on the loan, the lender’s rights are limited to seizing the specific asset purchased – they cannot pursue other assets within the fund. This “limited recourse” nature provides crucial protection for your retirement savings.

Consider the case of John and Sarah, SMSF trustees who rushed into a property purchase without properly reviewing their LRBA documentation. Their loan agreement contained a cross-collateralization clause that potentially exposed other fund assets to the lender – directly contradicting the limited recourse requirements of superannuation law. Had the ATO conducted an audit, their fund could have faced severe penalties, including loss of tax concessions.

As the ATO notes, “You must keep appropriate documentation, such as a written loan agreement, that shows you have made a genuine borrowing to acquire an asset.” This seemingly simple requirement underscores the fundamental importance of proper documentation in SMSF lending.

The structure of an LRBA involves several key components:

- The SMSF trustee obtains a loan to purchase an acquirable asset

- The asset is held in a separate holding trust until the loan is repaid

- The SMSF trustee has a beneficial interest in the asset

- The SMSF trustee has the right to acquire legal ownership of the asset after loan repayment

Any deviation from this structure in your SMSF loan agreement could result in non-compliance, making thorough review essential before signing.

Critical Fine Print in SMSF Loan Agreements

The devil truly is in the details when it comes to SMSF loan agreements. Let’s examine the key terms that demand your scrutiny:

Loan Terms and Interest Rates

Your SMSF loan agreement must specify a clear loan term and interest rate structure that reflects commercial market rates. The ATO scrutinizes these elements closely, particularly for related-party loans (where the lender is connected to the SMSF). Even if you’re borrowing from a family member or related entity, the terms must mirror what would be available from an independent commercial lender.

Current market data suggests LRBA interest rates typically run 2-3% higher than standard residential mortgages due to their limited recourse nature. An interest rate significantly below market rates could flag your arrangement as non-arm’s length, potentially triggering punitive tax consequences.

Repayment Schedules

The repayment schedule outlined in your SMSF loan agreement must be feasible based on your fund’s cash flow. This includes considering:

- Principal and interest or interest-only periods

- Repayment frequency (monthly, quarterly, annually)

- Balloon payment requirements

- Early repayment options and penalties

A properly structured repayment schedule ensures your SMSF can meet its obligations without compromising other financial responsibilities, such as pension payments to members.

Default Clauses and Remedies

Perhaps the most critical section to review is the default clause. This outlines what happens if your SMSF fails to meet its repayment obligations. In a compliant LRBA, the lender’s recourse should be explicitly limited to the specific asset purchased, with no access to other SMSF assets.

Watch for hidden clauses that might extend the lender’s rights beyond the asset in question. Such provisions could invalidate the limited recourse nature of the arrangement and create serious compliance issues.

Security and Guarantees

Your SMSF loan agreement should clearly state that the purchased asset serves as the sole security for the loan. Personal guarantees from SMSF members are permitted by law but require careful consideration, as they create personal financial exposure in the event of default.

According to superannuation specialists, approximately 85% of SMSF loans involve some form of personal guarantee from members, making this a particularly important area to understand fully.

Documentation and Record-Keeping Best Practices

Maintaining comprehensive documentation isn’t just about satisfying regulatory requirements – it’s about protecting your retirement investments through proper governance. For SMSF loan agreements, this means:

Formal Written Agreements: All loan arrangements, even between related parties, must be formalized in writing with clear commercial terms.

Meeting Minutes: Document trustee decisions regarding the loan, including the rationale for the borrowing and how it aligns with the fund’s investment strategy.

Valuation Evidence: Maintain independent valuation documentation to support the purchase price and demonstrate arm’s length transactions.

Annual Reviews: Regularly review loan terms and compliance as part of your fund’s annual administration process.

Payment Records: Keep meticulous records of all loan repayments, including principal and interest components.

The ATO has increased its focus on SMSF lending compliance in recent years, with documentation deficiencies among the most common audit triggers. One study found that nearly 40% of SMSF compliance breaches involved inadequate loan documentation – a preventable risk with proper attention to detail.

Professional Guidance: The Key to Compliance

The complexity of SMSF loan agreements makes professional guidance not just valuable but essential. This specialized area requires expertise across multiple disciplines:

Financial Advisors

A qualified financial advisor can help determine whether an LRBA aligns with your broader retirement strategy and fund objectives. They can model the long-term impact of the loan on your retirement outcomes and help structure repayments to optimize cash flow.

Legal Experts

SMSF-experienced legal professionals can review loan agreement terms to ensure compliance with superannuation law. They can identify problematic clauses that might compromise the limited recourse nature of the arrangement or create other compliance risks. This expertise is particularly valuable when structuring a compliant LRBA.

SMSF Lending Specialists

Working with lenders who specialize in SMSF lending, like Aries Financial Pty Ltd, provides access to expertise specifically tailored to SMSF borrowing requirements. Such specialists understand the unique compliance landscape and can structure loan agreements that satisfy both commercial and regulatory needs.

At Aries Financial Pty Ltd, Australia’s Trusted SMSF Lending Specialist, we prioritize integrity, expertise, and client empowerment through properly structured SMSF loan agreements. Our approach focuses on educating trustees about critical loan terms while ensuring full compliance with superannuation regulations. This commitment to both education and compliance exemplifies the professional guidance necessary for successful SMSF borrowing.

“The right SMSF loan agreement doesn’t just facilitate property acquisition – it creates a foundation for compliant, successful wealth building through your self-managed super fund,” notes a senior advisor at Aries Financial. “Our focus is ensuring clients understand every aspect of their loan agreement before signing.”

Actionable Advice for SMSF Trustees

Armed with knowledge about the critical fine print in SMSF loan agreements, consider these actionable steps to protect your retirement investments:

Review Your Investment Strategy: Before pursuing an LRBA, ensure your fund’s investment strategy explicitly allows for borrowing and property investment. This documentation is your first line of defense in demonstrating compliance.

Seek Multiple Professional Opinions: Obtain reviews from both financial and legal experts before finalizing any SMSF loan agreement. The cost of these reviews is significantly less than potential penalties for non-compliance.

Compare Loan Offers Carefully: Look beyond interest rates to examine default provisions, guarantee requirements, and flexibility options. The cheapest loan isn’t always the most suitable for SMSF purposes.

Document Your Due Diligence: Maintain records of all research, professional advice, and market comparisons made during the loan selection process. This demonstrates trustee diligence if ever questioned.

Schedule Regular Compliance Reviews: Set calendar reminders for annual reviews of your SMSF loan agreement to ensure ongoing compliance with any regulatory changes.

Conclusion: Empowerment Through Understanding

The fine print in your SMSF loan agreement isn’t just legal jargon – it’s the framework that determines whether your property investment strengthens or potentially damages your retirement position. By approaching these agreements with thorough understanding and professional guidance, you transform what many see as administrative burden into a powerful wealth-building tool.

The most successful SMSF trustees recognize that empowerment comes through education and expertise. They take the time to understand critical loan terms, seek specialized guidance, and maintain rigorous compliance practices. This approach aligns perfectly with the philosophy that guides firms like Aries Financial Pty Ltd – that integrity, expertise, and client empowerment are the foundation of sound SMSF lending.

Your retirement security deserves nothing less than complete attention to the details that matter most. When it comes to SMSF loan agreements, understanding the fine print isn’t just prudent – it’s essential to ensure your hard-earned retirement savings are protected while pursuing growth through property investment.

By approaching SMSF borrowing with diligence and informed perspective, you position yourself to make strategic property investments that truly enhance your retirement outlook while navigating the regulatory landscape with confidence. After all, the fine print in your SMSF loan agreement isn’t just about compliance – it’s about creating the secure and prosperous retirement you’ve worked so hard to achieve.