When it comes to securing your financial future through your Self-Managed Super Fund (SMSF), few documents carry more weight than a properly structured loan agreement. For SMSF trustees, property investors, financial advisors, and business owners alike, understanding the critical components of an SMSF loan agreement template isn’t just a regulatory formality—it’s an essential safeguard for your retirement wealth.

As Australia’s regulations around SMSF borrowing continue to evolve, a well-crafted SMSF loan agreement template has become the cornerstone of compliant and successful property investment through your super fund. At its core, this legal document establishes the terms between your SMSF and the lender while ensuring adherence to the strict guidelines set by Australian authorities.

Let’s explore the 10 critical clauses that should be included in every SMSF loan agreement template and understand why your financial future literally depends on getting these right.

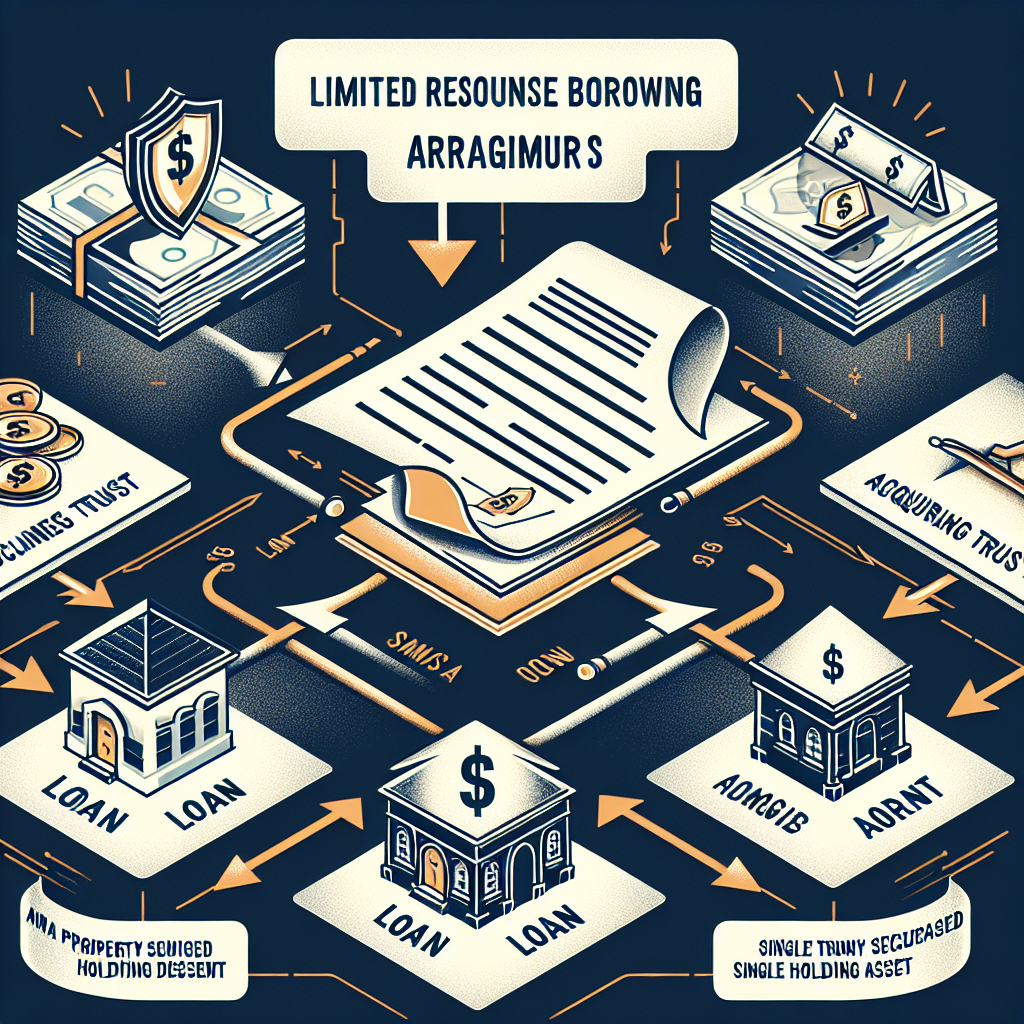

1. Limited Recourse Borrowing Arrangements (LRBA) Structure

Key Point: The limited recourse nature of SMSF loans is what protects your broader retirement savings from risk.

The foundational clause of any SMSF loan agreement template must explicitly establish the limited recourse nature of the borrowing. This isn’t just a legal technicality—it’s the protective framework that shields your entire super fund.

Under an LRBA, the lender’s rights to recover borrowed funds are restricted to the specific asset purchased with the loan. This means that in case of default, other assets in your SMSF remain protected. Without this clear limitation, your entire retirement savings could be at risk.

“The regulatory environment for SMSF Borrowing Funds underlines a commitment to safeguarding the fund’s assets through Limited Recourse Borrowing arrangements,” notes the Australian Taxation Office in their guidance materials. This commitment to protection must be reflected precisely in your SMSF loan agreement template.

2. Loan Amount, Term, and Interest Rate Specifications

A comprehensive SMSF loan agreement template must clearly outline the fundamentals: how much is being borrowed, for how long, and at what cost. These seemingly straightforward details require careful consideration to ensure they align with both market conditions and compliance requirements.

The loan amount should reflect a sustainable borrowing level for your SMSF, typically up to 80-90% of the property value. Terms generally range from 15-30 years, though some lenders offer shorter options. Interest rates must be commercial in nature and documented properly to avoid Non-Arm’s Length Income (NALI) issues.

Remember that an SMSF loan with non-commercial terms can trigger significant tax penalties, with income potentially taxed at 45% rather than the concessional super rate of 15%. This single clause, if incorrectly specified, can drastically alter your investment returns.

3. Security and Collateral Provisions

Important: Security arrangements must comply with Section 67A requirements to maintain your fund’s compliance status.

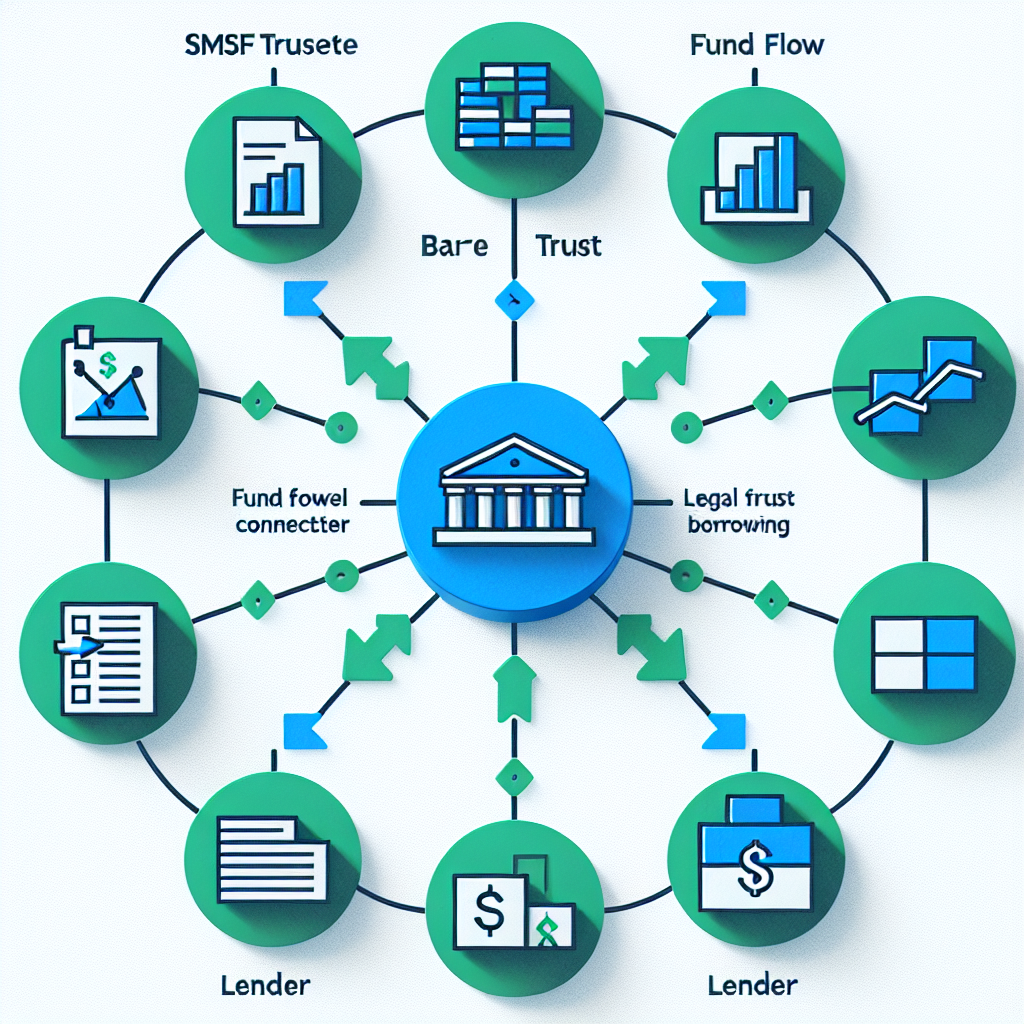

Your SMSF loan agreement template must precisely identify the security property and the nature of the legal interest being provided to the lender. This includes the establishment of a holding trust arrangement, a critical component of SMSF borrowing compliance.

Under the security provisions, the SMSF trustee acquires the beneficial interest in the property, while legal ownership is held by a separate trustee entity. This structure ensures compliance with Section 67A of the Superannuation Industry (Supervision) Act 1993, which prohibits the SMSF trustee from granting security over other fund assets.

The security clause should specify:

– The exact property being secured

- The holding trust arrangements

- The limitations on the lender’s recourse

- The process for transferring legal ownership to the SMSF once the loan is repaid

Without these clearly defined security provisions, your SMSF loan may fail to meet regulatory requirements, potentially resulting in severe compliance breaches.

4. Repayment Schedule and Default Provisions

Perhaps no clauses in your SMSF loan agreement template are more directly tied to your financial future than those addressing repayment terms and consequences of default. These provisions must be meticulously crafted to ensure your SMSF can meet its obligations while maintaining compliance.

The repayment schedule should outline:

– Payment frequency (typically monthly)

- Principal and interest allocation

- Early repayment options and any associated fees

- Provisions for payment adjustments during interest rate changes

Default provisions are equally critical, specifying the remedies available to the lender if repayments aren’t made. Remember that under LRBA rules, these remedies must be limited to the secured property—but even this limited recourse can significantly impact your retirement planning if triggered.

5. Single Acquirable Asset Clause

A compliant SMSF loan agreement template must include language that confirms the borrowed funds will be used to acquire a single acquirable asset. This isn’t just regulatory jargon—it’s a fundamental limitation that shapes what your SMSF can purchase using borrowed funds.

Under Section 67A of the SIS Act, an SMSF can only use borrowed funds to purchase one single acquirable asset. This means your loan agreement must specifically identify that asset and prohibit the use of funds for multiple purchases or for property improvements that would alter the character of the asset.

The consequences of violating this provision can be severe, potentially leading to the forced sale of the property and significant tax penalties. Your SMSF loan agreement template must therefore be unambiguous about this restriction.

6. Arm’s Length Transaction Requirements

Tax Alert: Non-arm’s length arrangements can trigger punitive tax rates of up to 45% on investment income.

To prevent manipulation of the super system, your SMSF loan agreement template must include provisions ensuring the entire transaction is conducted on commercial terms. This “arm’s length” requirement applies to every aspect of the loan, from interest rates to repayment terms.

The Australian Taxation Office scrutinizes SMSF loans closely for evidence of non-arm’s length arrangements. If terms are found to be unusually favorable, the income from your investment property could be reclassified as Non-Arm’s Length Income (NALI) and taxed at the highest marginal rate.

This clause should explicitly state that the loan terms reflect market conditions and that all parties are acting independently in their best interests. Documentation of how these commercial terms were determined should be maintained alongside the loan agreement itself.

7. Loan Purpose and Compliance Declarations

Your SMSF loan agreement template should include explicit statements regarding the purpose of the loan and declarations that all parties understand the compliance requirements. This creates a clear record of intent that can be invaluable during regulatory reviews.

The purpose clause should specifically reference that the borrowing is being established under an LRBA as permitted by Section 67A of the SIS Act, and that the funds will be used solely for the acquisition of the identified investment property.

Additionally, this section should include acknowledgments from all parties that they understand:

– The sole purpose test requirements

- Restrictions on related party transactions

- The prohibition on using the property for personal use

- Requirements for the property to be maintained in accordance with the investment strategy

8. Costs, Fees, and Expense Allocations

A comprehensive SMSF loan agreement template must clearly address how various costs associated with the loan will be handled. This includes establishment fees, ongoing service charges, and expenses related to the security property.

This clause should detail:

– Loan establishment fees

- Ongoing account keeping fees

- Legal costs for document preparation

- Valuation expenses

- Break costs for early repayment

- Insurance requirements and associated premiums

The allocation of these expenses between the SMSF and other parties must be clearly documented to avoid compliance issues. Remember that certain costs must be borne by the SMSF itself, while others may be the responsibility of the holding trustee or other entities involved in the arrangement.

9. Variation and Amendment Provisions

Financial circumstances change, and your SMSF loan agreement template should include mechanisms for adjusting the loan terms while maintaining compliance. These variation provisions are often overlooked but can be crucial for managing your investment over time.

Any amendments to an SMSF loan must continue to satisfy the original compliance requirements, particularly regarding commercial terms and the limited recourse nature of the borrowing. Your agreement should outline the process for:

– Interest rate adjustments

- Change in repayment frequency

- Extension of loan term

- Refinancing options

- Property substitution (in limited circumstances)

Without clear amendment provisions, you might find yourself locked into unfavorable terms or forced to refinance entirely, incurring unnecessary costs and potential compliance risks.

10. Exit Strategy and Loan Discharge Procedures

The final critical component of your SMSF loan agreement template addresses how the loan relationship will eventually conclude. A clear exit strategy is essential for long-term financial planning and ensures a smooth transition of legal ownership.

This clause should detail:

- The process for final repayment notification

- Requirements for release of security

- Transfer of legal title to the SMSF trustee

- Timing requirements for document processing

- Responsibilities for costs associated with discharge

The discharge procedures are particularly important as they ultimately fulfill the purpose of the LRBA—to allow your SMSF to acquire full ownership of the investment property. Without clear provisions, this final transfer can be delayed or complicated, potentially affecting your retirement plans.

Ensuring Compliance with Australian Regulations

Regulatory Notice: ATO scrutiny of SMSF loan arrangements has increased significantly in recent years.

Beyond these ten critical clauses, your SMSF loan agreement template must align with the broader regulatory framework governing superannuation in Australia. The Superannuation Industry (Supervision) Act 1993 establishes stringent requirements that directly impact how SMSF loans can be structured.

The Australian Taxation Office (ATO) serves as the primary regulator for SMSFs, overseeing compliance with both tax laws and superannuation regulations. Their scrutiny of SMSF borrowing arrangements has intensified in recent years, making proper documentation more important than ever.

Key regulatory considerations that should influence your SMSF loan agreement template include:

- Section 65 (prohibition on loans to SMSF members)

- Section 83 (in-house asset rules)

- Section 62 (sole purpose test)

- Section 109 (arm’s length rules)

- Section 35D (requirement to keep records)

Failure to align your loan agreement with these provisions can result in severe penalties, including the loss of concessional tax treatment for your entire fund. This underscores why working with specialists in SMSF lending is crucial for protecting your financial future.

The Aries Financial Approach to SMSF Loan Agreements

At Aries Financial Pty Ltd, our philosophy of integrity, expertise, and empowerment shapes how we approach SMSF loan agreements. As Australia’s trusted SMSF lending specialist, we understand that a properly structured loan agreement is not just about compliance—it’s about creating secure foundations for wealth creation.

Our team specializes in crafting SMSF loan agreement templates that not only meet regulatory requirements but also optimize your investment strategy. With the ability to borrow up to 90% of property value and approval timeframes as quick as 1-3 days, we combine efficiency with uncompromising attention to compliance details.

“The most secure SMSF investments are built on meticulous documentation and strategic planning,” explains our senior lending specialist. “A well-structured loan agreement isn’t just paperwork—it’s the framework that determines whether your property investment will thrive or struggle under regulatory scrutiny.”

Conclusion: Protecting Your Financial Future

Final Thought: A properly structured SMSF loan agreement is not just about compliance—it’s about creating secure foundations for your retirement wealth.

Your SMSF loan agreement template is far more than a formal document—it’s the blueprint for how your retirement investment will operate within Australia’s complex regulatory environment. Each clause represents not just a legal requirement but a strategic decision that will impact your financial future.

As you consider property investment through your SMSF, remember that the quality of your loan documentation will determine both your compliance status and your investment outcomes. The ten critical clauses we’ve explored form the foundation of a secure borrowing arrangement, but their proper implementation requires specialized knowledge.

Aries Financial Pty Ltd stands ready to help you navigate these complexities with our deep industry expertise and commitment to compliance. Our vision is to be Australia’s most trusted SMSF lending provider, offering strategic investment opportunities backed by sound documentation and regulatory alignment.

Whether you’re an SMSF trustee exploring property investment options, a financial advisor guiding clients through retirement planning, or a business owner looking to diversify your super holdings, ensuring your loan agreement contains these critical clauses will help secure the financial future you’re working to build.

Don’t leave your SMSF loan agreement to chance. Partner with specialists who understand both the letter of the law and the spirit of wealth creation through strategic property investment.