Self-Managed Super Funds (SMSFs) have become increasingly popular among Australians who want greater control over their retirement savings. With over 600,000 SMSFs currently operating across the country, more Australians are discovering the benefits of directing their own investment decisions and tailoring strategies to their specific retirement goals.

One powerful yet often overlooked strategy for SMSF trustees is refinancing existing loans within their fund. SMSF refinancing presents a strategic opportunity to enhance your retirement savings through reduced costs and improved investment outcomes. As interest rates and lending markets evolve, refinancing can significantly impact your fund’s performance and long-term growth potential.

Understanding Self-Managed Super Funds

SMSFs provide members with direct control over their retirement investments, offering flexibility and choice beyond what traditional superannuation funds typically allow. As the trustee of your own SMSF, you can make decisions about investment properties, shares, managed funds, and other asset classes that align with your retirement objectives.

This control comes with significant responsibility. SMSF trustees must navigate complex regulatory requirements while making sound investment decisions that preserve and grow retirement wealth. The Australian Taxation Office (ATO) closely monitors SMSF compliance, requiring trustees to maintain proper records, implement suitable investment strategies, and ensure all transactions meet strict regulatory standards.

When properly managed, SMSFs can deliver exceptional retirement outcomes through strategic investment choices, tax efficiency, and direct control of assets. SMSF refinancing represents one such strategic approach that can enhance fund performance through improved loan structures and reduced costs.

What Is SMSF Refinancing?

SMSF refinancing involves replacing an existing loan within your self-managed super fund with a new loan that offers more favorable terms. Typically, the primary goal is securing a lower interest rate, but refinancing may also provide improved loan features, better repayment flexibility, or access to facilities like offset accounts that weren’t available with the original loan.

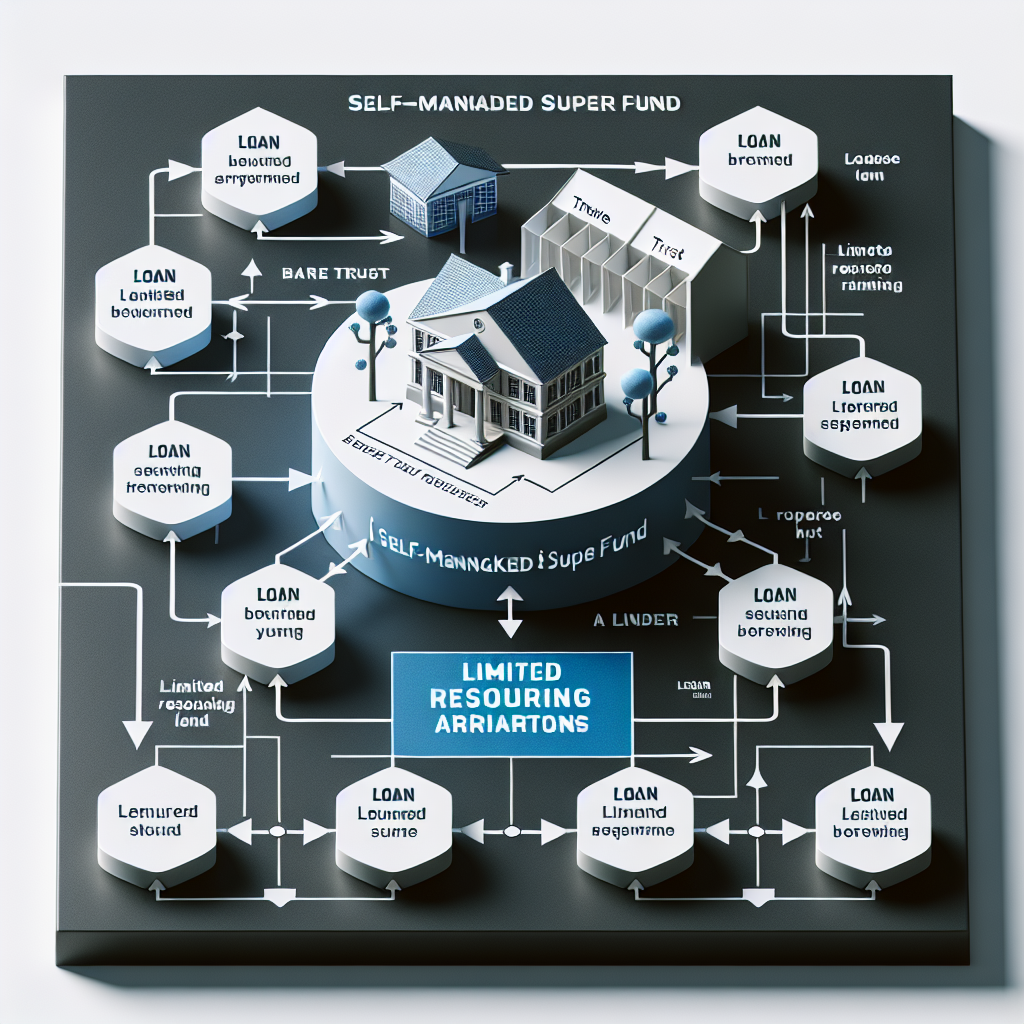

The mechanics of SMSF refinancing are similar to traditional refinancing, but with additional compliance requirements to ensure the transaction adheres to superannuation regulations. When an SMSF has borrowed to purchase an investment property through a Limited Recourse Borrowing Arrangement (LRBA), refinancing allows the fund to potentially secure better loan terms without disrupting the underlying investment.

For example, if your SMSF borrowed to purchase a $750,000 commercial property five years ago at an interest rate of 5.5%, today’s market might offer rates closer to 4.5% for similar loans. Refinancing could save your fund thousands of dollars annually in interest payments, directly improving the fund’s cash flow and long-term performance.

It’s important to note that SMSF loans differ from standard property loans in several key ways:

– They typically have stricter lending criteria

- Loan-to-value ratios (LVRs) are generally capped at 80%

- Interest rates may be higher than standard residential loans

- The entire refinancing cost must remain within the permitted borrowing limits

Despite these constraints, SMSF refinancing represents a valuable opportunity for trustees to optimize their fund’s financial position and enhance retirement outcomes.

Key Benefits of SMSF Refinancing

Lower Interest Rates

The most obvious benefit of SMSF refinancing is securing a reduced interest rate. Even a seemingly small reduction can deliver substantial savings over the life of a loan. For instance, reducing an SMSF loan’s interest rate from 5.5% to 4.5% on a $500,000 loan could save approximately $5,000 annually in interest costs. Over a 15-year loan term, these savings could exceed $75,000 – a significant contribution to retirement wealth.

As one SMSF trustee recently shared: “When we refinanced our fund’s commercial property loan, we secured a 0.85% interest rate reduction. The savings have significantly improved our fund’s cash flow, allowing us to increase contributions and diversify into other investments.”

Enhanced Cash Flow

Improved loan terms often translate to better cash flow within the fund. Lower monthly repayments mean more resources available for additional investments, increased contributions, or building a cash reserve. This improved liquidity gives trustees greater flexibility in managing their retirement strategy.

Enhanced cash flow is particularly valuable for SMSFs holding income-producing properties. When loan costs decrease, the net rental yield increases, potentially transforming marginally performing assets into stronger contributors to retirement wealth.

Access to Better Loan Features

Modern SMSF loans often include features that weren’t widely available when many trustees established their original borrowing arrangements. Offset accounts, redraw facilities, and flexible repayment options can significantly enhance your fund’s financial efficiency.

For example, some lenders now offer offset facilities with their SMSF loans, allowing trustees to use the fund’s cash reserves to reduce interest costs while maintaining liquidity. This approach can be particularly effective for funds maintaining the liquidity necessary to meet pension payment obligations.

Strategic Reinvestment Opportunities

The savings generated through SMSF refinancing create opportunities for strategic reinvestment. Trustees can direct these savings toward additional contributions, new investments, or accelerated loan repayment – each potentially enhancing long-term retirement outcomes.

Consider this practical example: An SMSF refinances its $600,000 investment property loan, reducing interest costs by $6,000 annually. The trustees choose to reinvest these savings into Australian shares paying an average 4.5% dividend yield. Over ten years, this reinvestment strategy could generate more than $77,000 in additional retirement wealth through compounding returns.

Maintaining Investment Strategy Compliance

When undertaking SMSF refinancing, it’s essential to ensure the transaction aligns with your fund’s investment strategy. The ATO requires all SMSFs to maintain a written investment strategy that addresses:

– Risk and return objectives

- Diversification of investments

- Liquidity needs

- Fund solvency

- Insurance considerations for members

Your investment strategy must be regularly reviewed and updated to reflect changes in your financial circumstances, market conditions, and regulatory requirements. Refinancing represents a significant financial decision that should be documented as part of your strategy review process.

The ATO has increasingly focused on ensuring SMSFs maintain proper investment strategies, with potential penalties for non-compliance. When refinancing, take the opportunity to review your entire strategy document, ensuring it accurately reflects current investment holdings, risk tolerance, and retirement objectives.

As noted in recent ATO guidance: “An SMSF investment strategy should be in writing and tailored specifically to your fund’s circumstances. It should not be a repeat of the legislation.” This highlights the importance of creating meaningful strategy documentation that genuinely guides your fund’s activities, including refinancing decisions.

Key Considerations Before Refinancing Your SMSF Loan

Evaluate All Costs Involved

While interest rate savings are important, trustees must consider all costs associated with refinancing. These may include:

– Application fees

- Valuation costs

- Settlement fees

- Legal expenses

- Early repayment penalties on the existing loan

- Ongoing fees with the new lender

A comprehensive cost-benefit analysis is essential to ensure refinancing delivers genuine value. In some cases, seemingly attractive interest rate reductions may be offset by high refinancing costs or unfavorable fee structures with the new lender.

Industry data suggests that refinancing costs for SMSF loans typically range from $2,000 to $5,000, depending on the property type, loan size, and lender requirements. Trustees should calculate the “break-even point” – the time required for interest savings to exceed these upfront costs.

Understand Loan Terms and Conditions

Beyond interest rates, carefully evaluate all terms and conditions of the proposed new loan. Consider factors such as:

– Loan term length

- Fixed vs. variable rate options

- Offset or redraw facilities

- Repayment flexibility

- Early repayment options

- Ongoing fee structure

Some lenders offer attractively low headline rates but impose restrictive conditions or high ongoing fees that reduce the overall benefit. Others may provide valuable features like offset accounts that can significantly enhance your fund’s financial efficiency.

Maintain Strict Regulatory Compliance

SMSF borrowing arrangements must comply with specific regulatory requirements, particularly the rules governing Limited Recourse Borrowing Arrangements (LRBAs). When refinancing, ensure that:

– The loan remains limited recourse in nature

- The underlying asset doesn’t change

- The borrowing arrangement maintains a proper bare trust structure

- All documentation properly reflects the SMSF as the beneficial owner

Non-compliant arrangements risk severe penalties, including potential loss of the fund’s tax-concessional status. Working with advisors experienced in SMSF lending is crucial to navigating these compliance requirements successfully.

Consult with SMSF Specialists

SMSF refinancing involves complex financial and regulatory considerations that benefit from specialist expertise. Before proceeding, consult with:

– An SMSF-specialized accountant

- A financial advisor with SMSF experience

- A mortgage broker familiar with SMSF lending options

- A lawyer experienced in superannuation law and property transactions

These professionals can help evaluate refinancing options, identify potential compliance issues, and ensure the transaction aligns with your broader retirement strategy. Their expertise can prevent costly mistakes and help maximize the benefits of refinancing.

As one specialist at Aries Financial Pty Ltd explains: “SMSF refinancing requires careful navigation of both lending markets and regulatory requirements. We regularly see trustees achieve significant savings by refinancing, but success depends on thorough planning and proper execution to ensure compliance.”

Making SMSF Refinancing Work for Your Retirement

Successful SMSF refinancing requires a strategic approach that balances immediate cost savings with long-term retirement objectives. Start by clarifying your fund’s goals – are you primarily seeking to reduce costs, improve cash flow, or access better loan features? This clarity will guide your refinancing decisions.

Next, thoroughly research current market offerings for SMSF loans. Lending options in this space have expanded significantly in recent years, with more competitive rates and innovative features becoming available. Don’t limit your search to major banks – many non-bank lenders like Aries Financial Pty Ltd specialize in SMSF lending and offer highly competitive options.

Remember that timing matters in refinancing decisions. Market conditions, interest rate trends, and your fund’s specific circumstances all influence the optimal timing for refinancing. In rising rate environments, securing a favorable fixed rate might be advantageous, while falling rate periods might suggest waiting for further reductions or choosing variable rate options.

Conclusion: Empowering Your Retirement Through Strategic Refinancing

SMSF refinancing represents a powerful opportunity to enhance your retirement savings through reduced costs and improved investment efficiency. By securing more favorable loan terms, trustees can potentially save thousands of dollars annually, creating new opportunities for growth and diversification within their funds.

However, successful refinancing requires careful planning, thorough research, and expert guidance to navigate the complex regulatory landscape governing SMSF borrowing. By partnering with specialists who understand both lending markets and superannuation regulations, trustees can maximize the benefits while avoiding compliance pitfalls.

As Australia’s trusted SMSF lending specialist, Aries Financial Pty Ltd helps trustees identify refinancing opportunities that align with their retirement objectives. Our focus on integrity, expertise, and empowerment ensures clients receive tailored solutions that enhance their financial future while maintaining strict regulatory compliance.

Consider reviewing your SMSF’s current loan arrangements to determine whether refinancing could benefit your retirement strategy. With proper planning and expert support, SMSF refinancing can be a significant step toward optimizing your fund’s performance and securing your financial future.