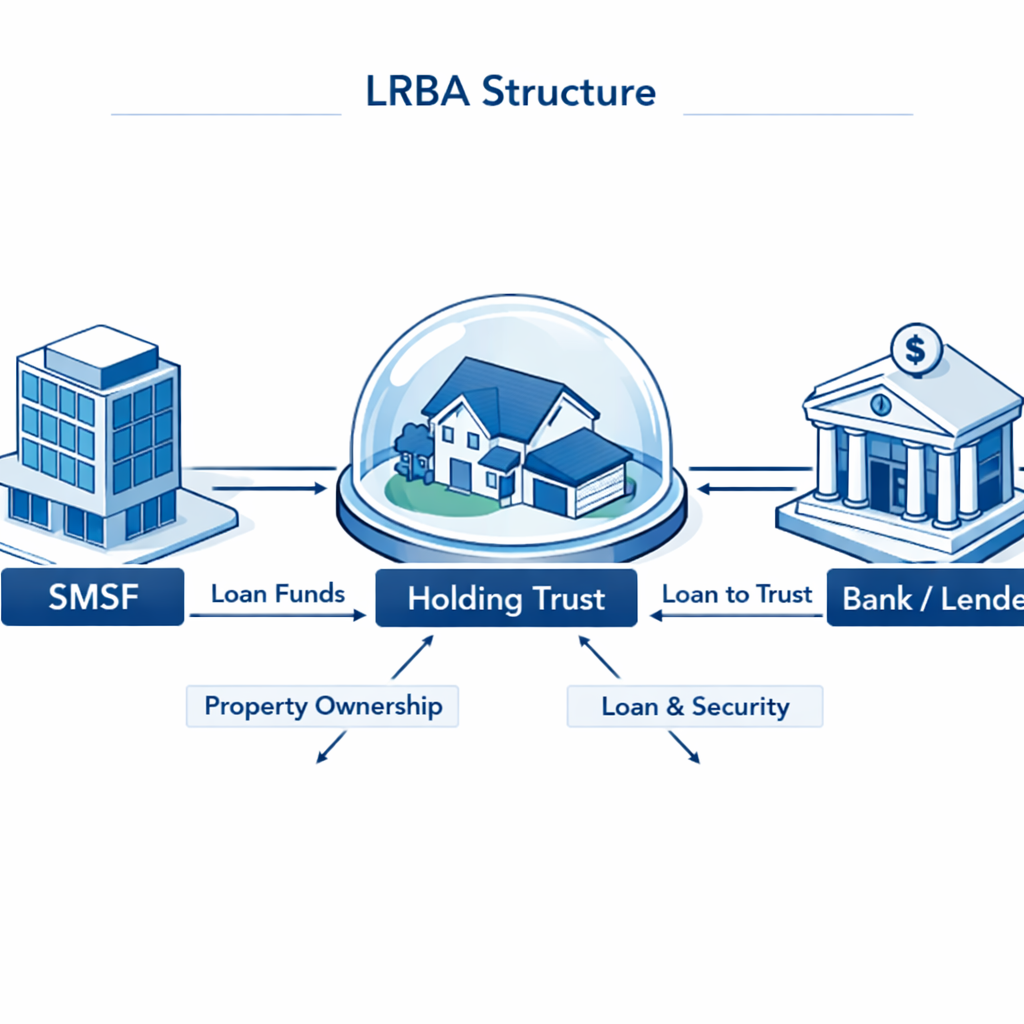

SMSF trustees considering borrowing face complex legal frameworks demanding careful navigation. Understanding Limited Recourse Borrowing Arrangements, asset protection structures, permissible investments, and compliance obligations protects your retirement savings while unlocking property investment opportunities through properly structured loans.

#smsf borrow #LRBA #SMSF compliance #superannuation borrowing #SMSF property investment #bare trust #limited recourse lending #SMSF trustee rights

SMSF Borrow: What Trustees Must Know About Legal Rights Before Taking a Loan Read More »