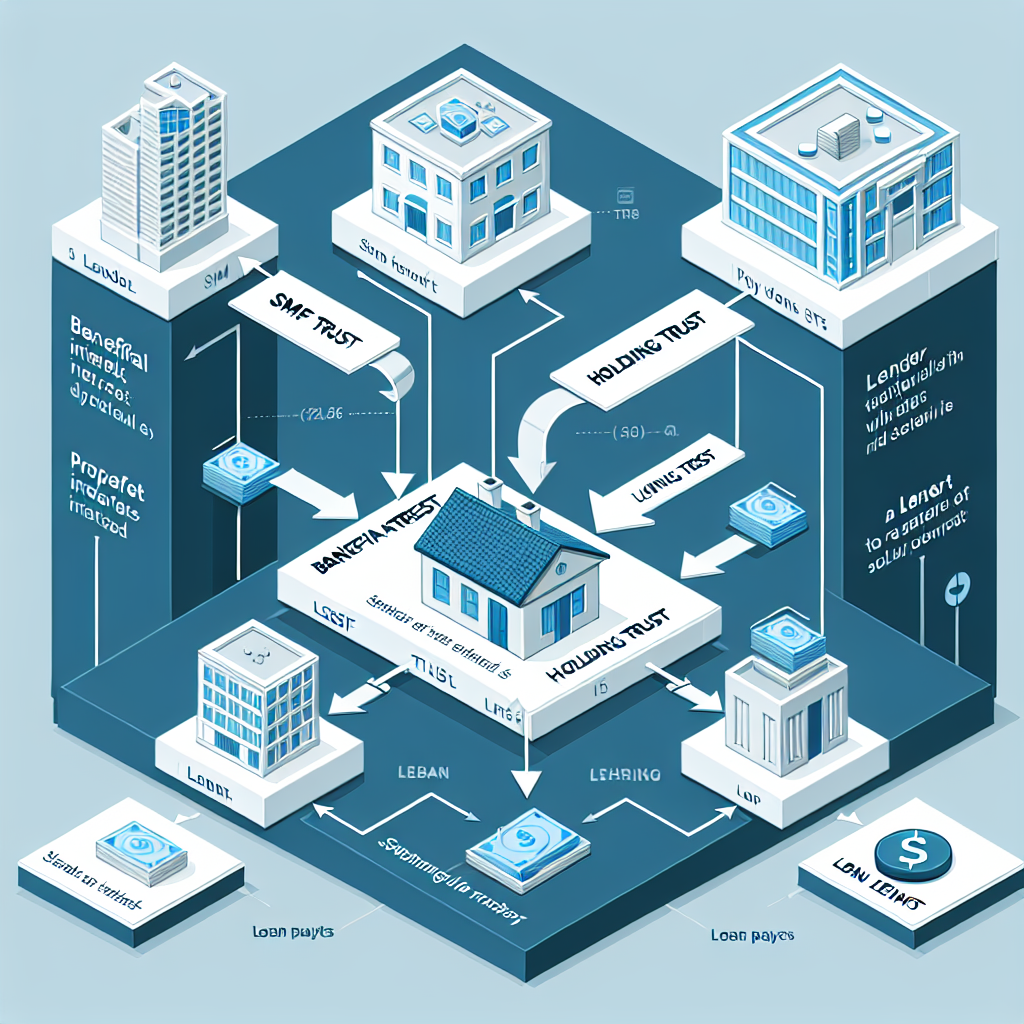

Limited recourse borrowing arrangements demand precision—one wrong move with ATO compliance can obliterate your SMSF’s tax benefits and expose decades of retirement savings. Discover the compliance traps costing trustees everything, and how proper structuring protects your wealth while maximizing property investment potential.

#limited recourse borrowing arrangement ato